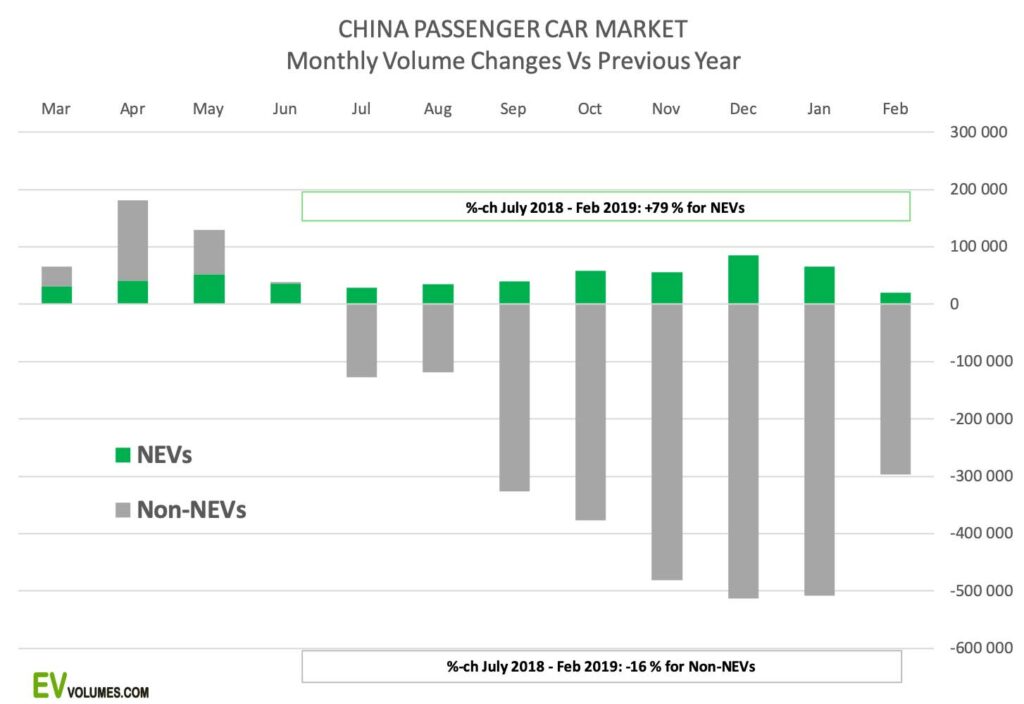

We held off the 2018 summary for a while in order to get a better idea about the overall market development and the changes in NEV subsidies for 2019. The Chinese car market has seen volume declines for eight consecutive months, which combine to a 10 % drop since June 2018 and 3% for the year. The losses have increased and February 2019 passenger car sales, including imports, were 18 % below last year. Various factors play in, like overspending on cars in previous years, purchase restrictions in mega-cities, better availability of sophisticated ride hailing and public transport. On top of it, the trade conflict with USA, impairing the business conditions for US makers.

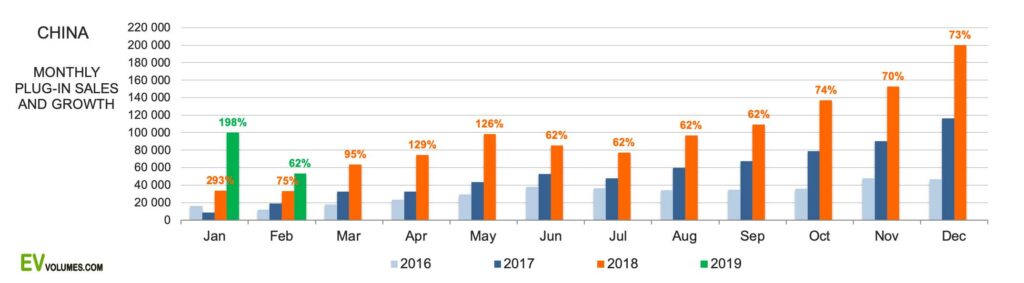

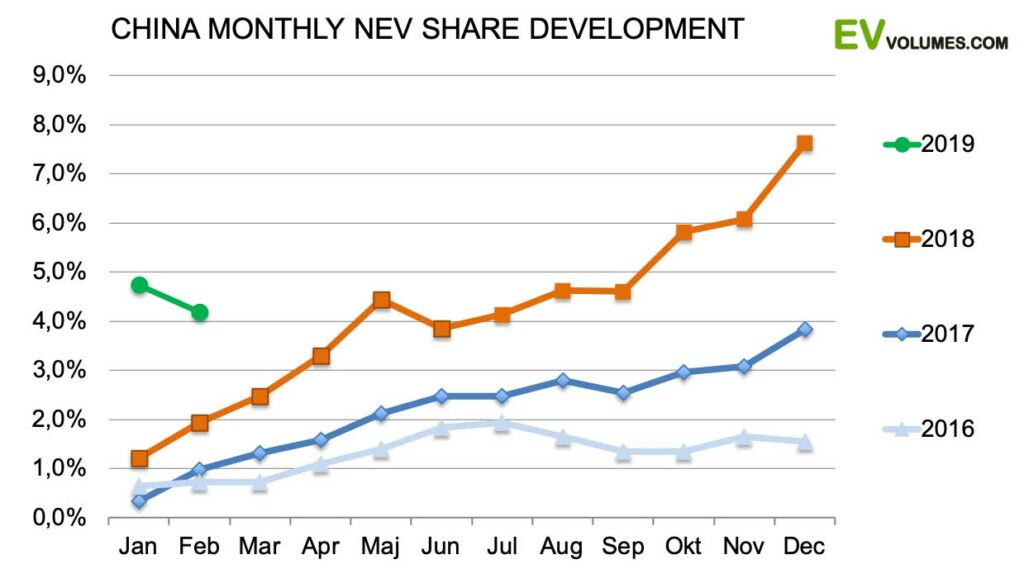

NEV sales held up well in this environment, so far. Volume increased 106 % in the 1st half, 68 % in the 2nd half of 2018 and 79 % for the year. China reached 1,1 million NEV passenger cars, plus 60 000 light commercial vehicles, corresponding to a market share of 4,2 % in the light vehicle sector. In December, their share was as high as 7,6 %. January results came in very strong, preliminary February results were more normal. Still, NEV demand could see a roller-coaster ride this year. NEVs with an e-range below 250 km (up from 150 km last year) do not qualify for subsidies anymore, those with longer e-range have subsidies cut by around 50 %. Direct local subsidies expire, in favour of charging infrastructure investments. Some OEM have indicated to lower list prices to compensate, still, NEVs above 250 km e-range can become 5-10 % more expensive for buyers. Those under 250 km range, mostly mini- and small cars, will become much less attractive as NEVs. The new rules become fully effective in July; following a 3 month grace time from April onwards, when grants are 40 % lower. Orders placed before April receive the 2018 subsidies.

The new regime further enforces the ministries target to consolidate the auto industry to fewer and more competitive players. Times will get tougher for makers of sub-standard models. 2019 will see the production of several low range EVs halted, either for battery upgrades, or infinitely. This happened in 2018, when the 150 km minimum range requirement was introduced. As 30 % of sales are in A and B segment cars (or A00 and A0 in Chinese terminology), it will leave a dent in the sales stats.

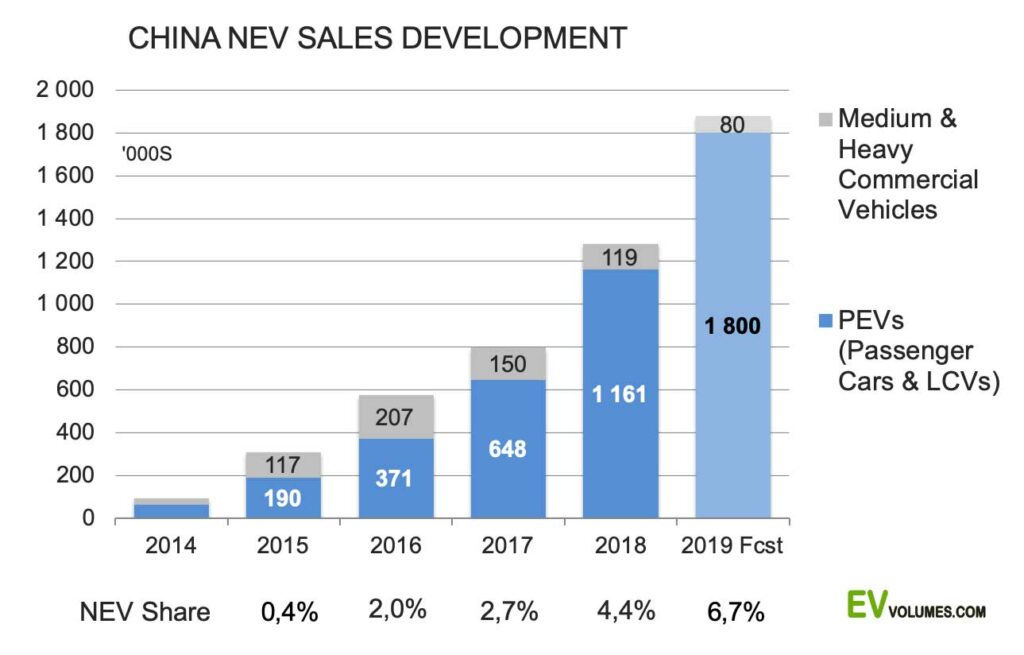

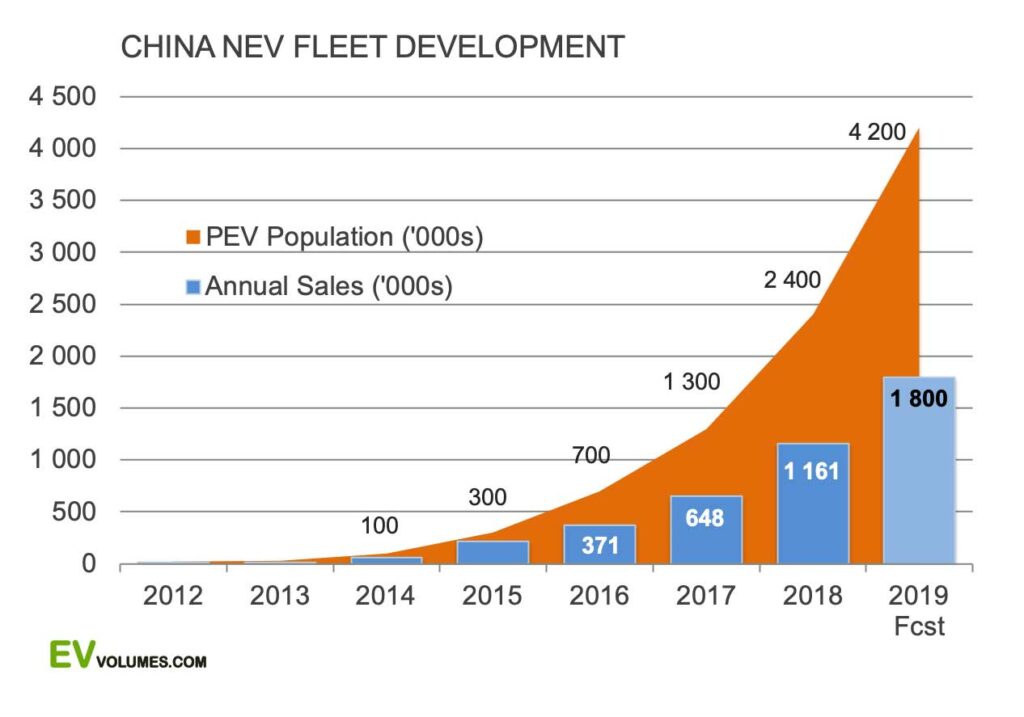

The forecast for 2019 has more uncertainty than last year. The current car market downturn is the first in decades and the recent rates of decline are disturbing. A “friendly” trade agreement can bring some relief, but without some easing in prices, taxes and ownership restrictions, the overall Car/SUV/MPV market can contract by 10 % or more this year. Whether this is acceptable, or even welcome for policy makers is hard to say. Our prediction for 2019 is a volume of 1,8 million NEVs, (Cars, SUVs, MPVs and LCVs) in a light vehicle market of 26,7 million, 3 % lower than 2018. This converts to a NEV share of 6,7 % and a growth of 55 % over 2018.

High gains for NEVs in a declining car market

The auto market in China has been in reverse since July 2018. Declines are accelerating and February sales were 18 % lower y-o-y, counting passenger cars of all propulsion types, incl. SUVs and MPVs. Losses were strongest in the economy and SUV segments, while mid-size and large sedans still posted growth. Among the OEMs hit hardest by the slump in therms of %-drops were smaller Chinese car makers, but also Ford, FCA and PSA. In terms of volume, GM, Ford, BAIC, Changan, PSA and Dongfeng were the biggest losers. Winners were BYD, BMW, Toyota and SAIC.

NEVs held up well during the downturn, increasing by 79 %, while all other types decreased by 16 %. Companies gaining significant NEV volume and sector share during this period were BYD, Hawtai, Dongfeng, Great Wall, GAC, BMW, VW and Hyundai. Volume losses, despite rapid sector growth, were posted by Kandi, Zotye, Lifan and, yes, Tesla. Model S and X are imported from USA and subject to a 25 % tariff surcharge since last summer, 40 % instead of the usual 15 %.

Growth reduced, but still high

China is, by far, the largest market for Plug-Ins. 2018 NEV sales reached 1 160 000 units, counting passenger cars and light commercial vehicles. This compares to 410 000 in Europe and 360 000 in USA. On top of that came 120 000 medium and heavy commercial vehicles, 80 % of them electric buses in metro areas. Subsidies were very generous, but have been reduced to avoid oversupply, explaining their decline since 2016. China is still world-leading in this category; outside China, the potential for large electric commercial vehicles is not addressed, yet. Total volume was a mere 2600 units, most of them based on Chinese vehicles, including batteries.

For the light vehicle portion, growth has been consistent and high: +96 % to 2016, +75 % to 2017 and +79 % to 2018. This year, we expect NEV sales to reach 1800 000 units, +55 %, counting passenger cars & LCVs, 75 % of them BEVs and 25 % Plug-in Hybrids (PHEV). In a total market estimated to 26,7 million by us (-3 % vs 2018), this means 6,7 % NEV share. Our growth expectation of +55 % is lower than for previous years due to the aforementioned curtailing of NEV subsidies and a general decline in passenger vehicle sales.

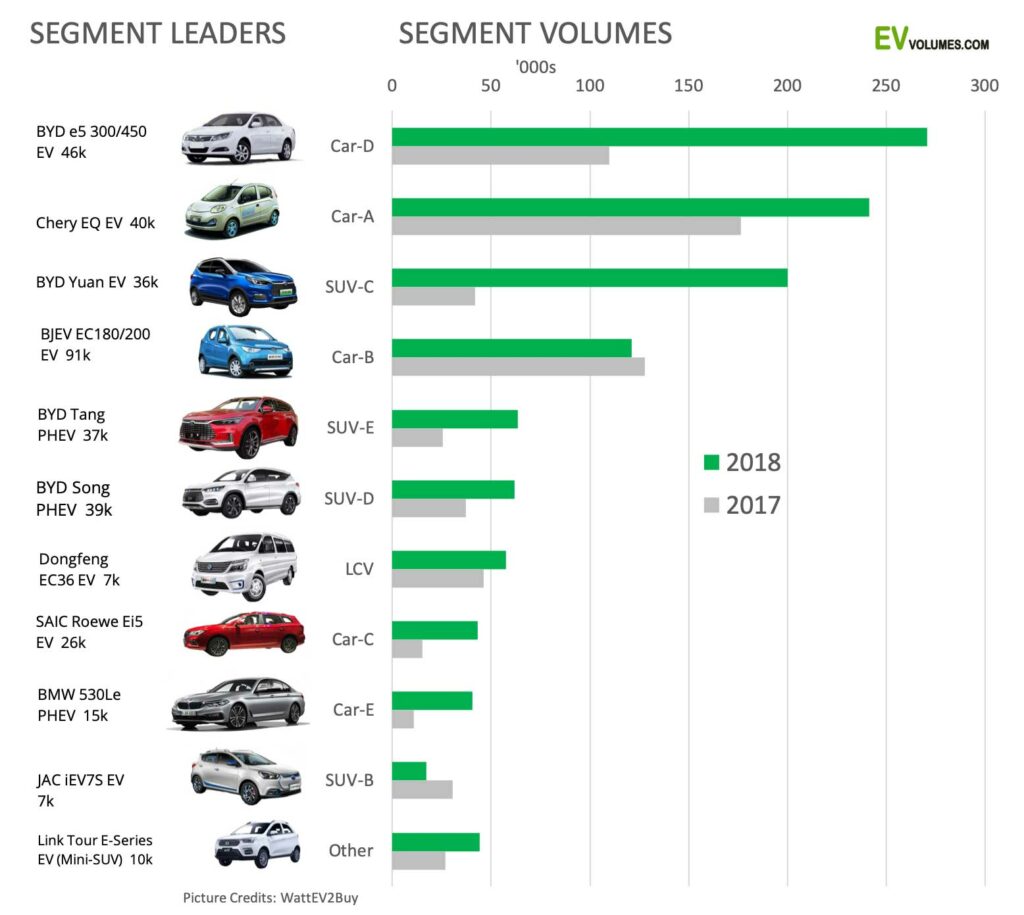

More SUVs, more sedans for ride hailing and more E-range for all

One reason for the Chinese lead in NEVs were their ultra-affordable and highly subsidised EVs in the Mini (A) and Small (B) segments. The industry is upgrading, however, as the Chinese Government continuously raises the bar for granting subsidies. The NEV segments are highly dynamic and compared to 2017 a lot has changed: Small cars lost ground, BYD upgraded their SUVs to make space for the new Yuan, which became an instant best-seller in the immensely popular compact SUV segment. The mid-size sedan segment is now the largest, due to the popularity of BEVs in the fast growing ride hailing sector. Losses for small cars: Several B-segment models did not reach the 150 km E-range requirement introduced mid-year and were paused for updates, or discontinued.

The BMW locally produced 5-Series PHEV became the winner in the E-Segment, displacing the imported Tesla Model-S, which does not receive subsidies and was burdened by higher import duties in the 2nd half of 2018. The mini-car segment had a series of sales jams among the previous segment leaders, but could still grow from new models with over 150km range.

A comment on segment nomenclature: EV-volumes uses a global segmentation scheme like many western car companies and agencies. In China vehicles are categorised into Cars, SUVs and MPV. No difference to what we do. Then, instead of our A to F segments, cars in China are classed into: A00 (=A, Mini), A0 (=B, Small), A (= C, Compact & D, Mid-Size), B (=E, Large) and C (=F, Luxury).

Formidable finish and a good start in 2019

Usually, NEV sales in China start low and finish high, with only ⅓rd of the annual volume in the first 6 months. December 2018 had a staggering 7,6 % NEV share in an otherwise depressed car market. Then, January came in with twice the normal rate and February was atypically lower. We can assume some overstocking at dealers here, ahead of the coming subsidy reductions. The ups and downs are likely to continue in the coming months, which makes 2019 harder to predict than the previous years.

Likely, 2019 will see a less steep increase in the 2nd half. We are expecting 6,8 % for the complete year of 2018, with an upside, if the car market continues to decline at the current pace. It appears that NEV demand is more resilient to car market downturns.

Exceeding Fleet Goals

The Chinese NEV fleet (vehicle population) reached 2,4 million in December 2018, counting light vehicles, 75 % more than at the end 2017. This puts China ahead of USA (1,1 m) and Europe (1,3 m). With around 200 million cars in operation in China, the PEV share is still just 1,2 % of the total fleet, but it is higher than in other regions, where fleet build-up has a stronger legacy portion. If China reached the motorisation rate of Europe or USA, it’s fleet would be 750 million cars, more than Europe and USA combined. Hardly sustainable with ICE propulsion.

5 million NEVs on the road by the end of 2020 is a previously stated target of Chinese authorities. This is for all vehicle types combined, including LCVs, trucks and buses. Even with a slower pace this year, this target will be met ahead of time. Another reason to further raise the bar for the industry.

Close

Close