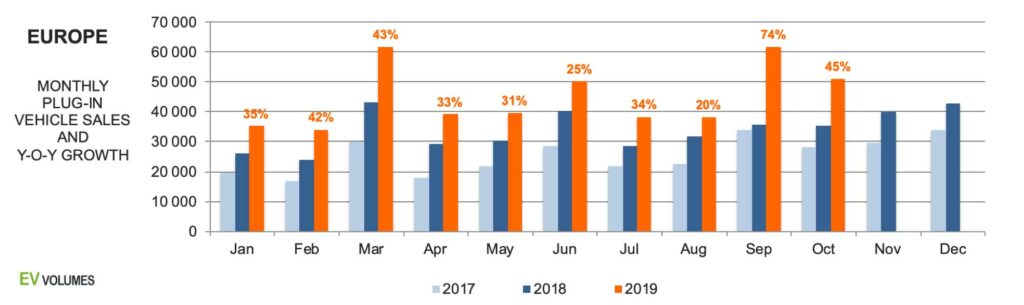

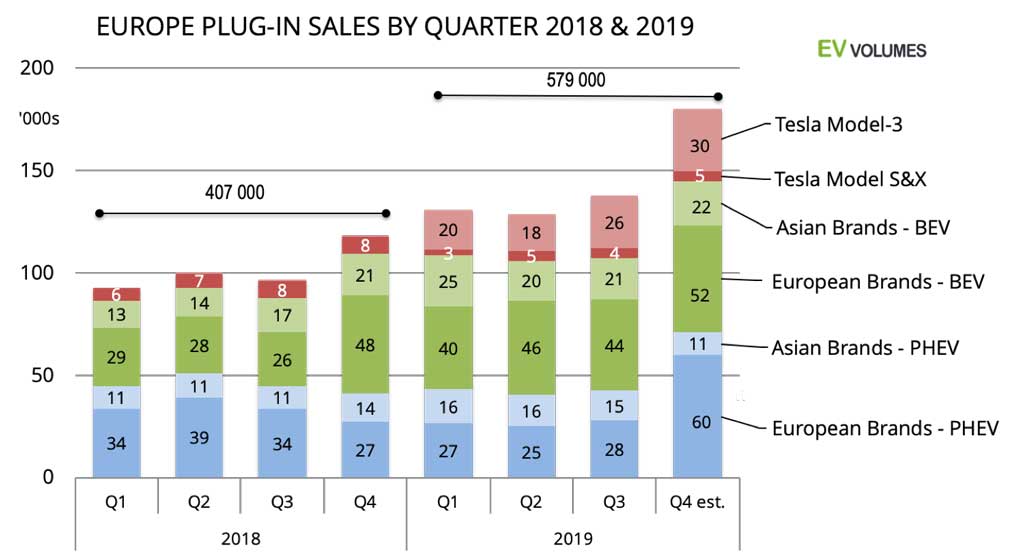

Europe sales of Battery Electric Vehicle (BEV) and Plug-in Hybrids (PHEV) were 400 000 units during Q1-Q3. October added another 51 400 sales. Year-to-date growth stands at 39 % over 2018. The September result was particularly strong when the re-launch of popular PHEV for BMW, Mercedes and VW and Porsche, together with high Tesla Model-3 deliveries, boosted the sector to 4,2 % market share, a new record. The first half of 2019 saw a strong shift towards pure electric vehicles (BEV), 68 % for 2019 H1, compared to 51 % for 2018 H1. The change reflected the introduction of the more stringent WLTP for fuel economy ratings, changes in taxation/grants promoting more BEV uptake and better availability of long-range BEVs, including the Model-3. Many PHEV were not available due to model-changes or battery upgrades for better e-range. Since September, the PHEVs are back and were an important growth contributor.

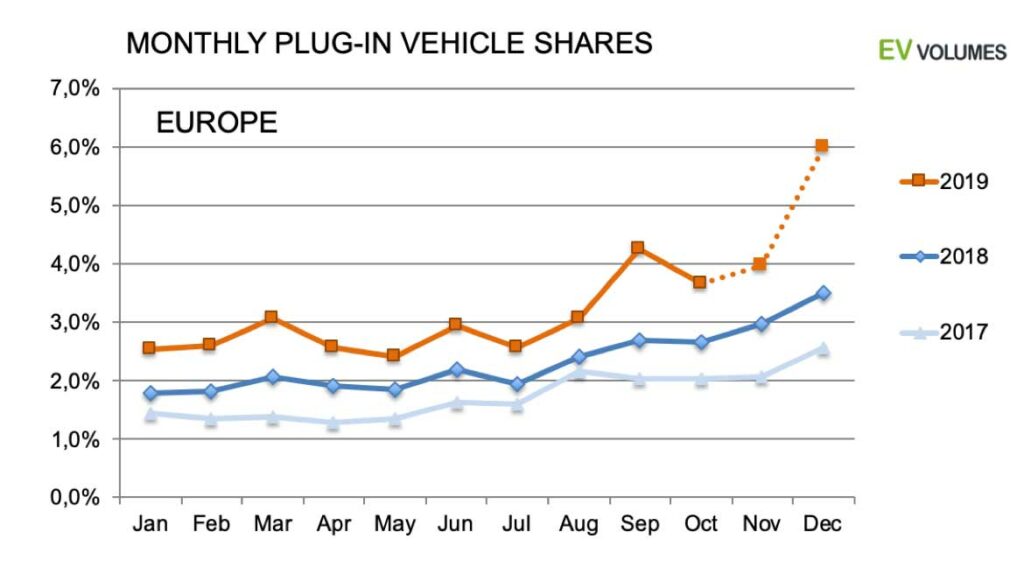

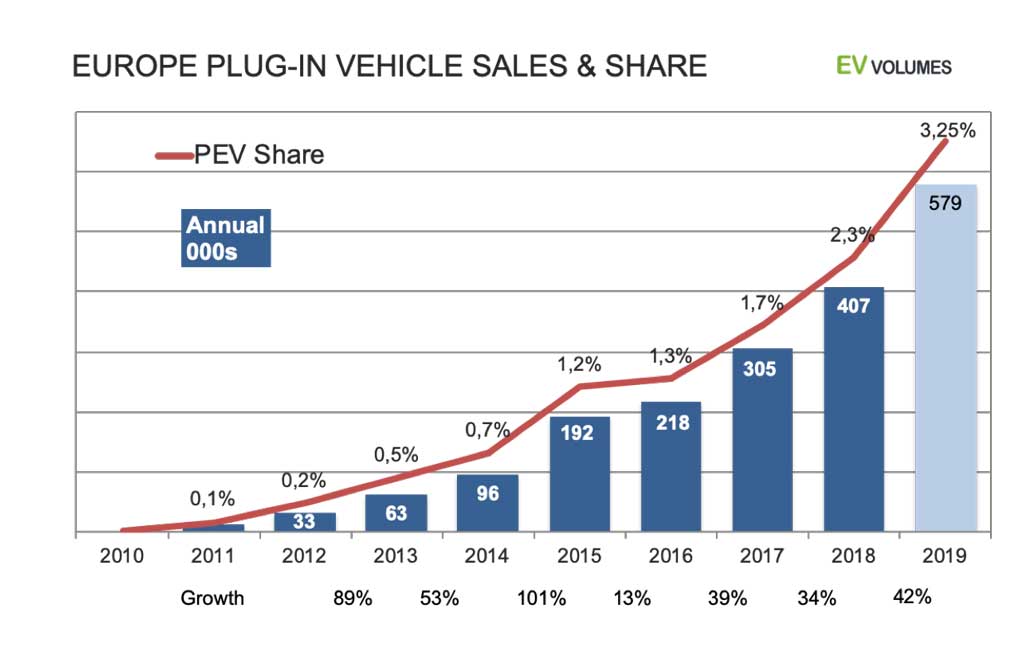

We expect strong results for the last 2 months: The re-bound for PHEV sales continues, Tesla needs to deliver on the guidance of at least 360 000 global deliveries for the year and the Netherlands increase the benefit in kind for the private use of BEV company cars for 2020. 2019 is likely to end with a total volume around 580 000 plug-ins, which is 42 % more than for 2018. Market share can go as high as 6 % in December and is 3,25 % for the year.

Tesla leads the OEM ranking with 78 200 sales year-to-date October, a sector share of 17 %. The BMW Group came second with 70 000 units. The Tesla Model-3 is the best selling plug-in with 65 600 deliveries, clearly ahead of the Renault Zoe with 39 400 sales.

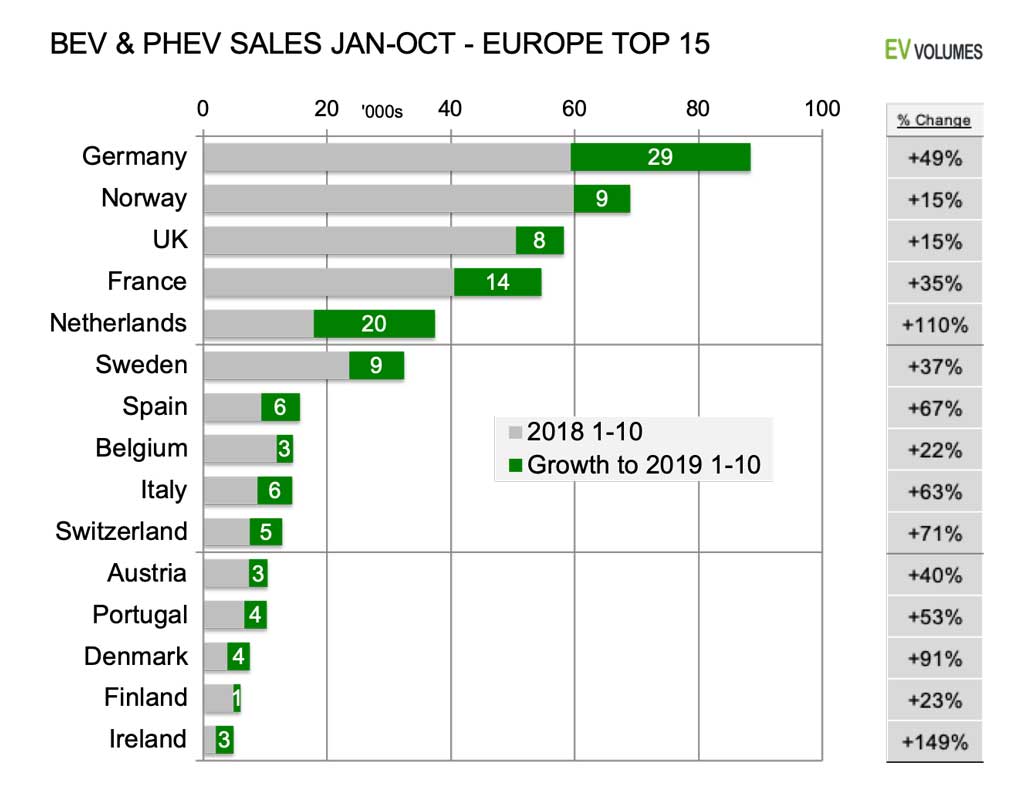

Germany and the Netherlands were the strongest growth contributors, in terms of volumes. Germany has become the largest market for plug-ins in Europe, displacing Norway to the #2 position. Norway is still the word leader in EV uptake, with a share of 45 % in this year’s light vehicle sales, up 6 %-points compared to last year. Iceland comes second with 22 % so far; within the EU, Sweden leads with 10 % of new car and LCV registrations being BEVs and PHEVs.

Definitely Greener

Despite weak PHEV supplies from their domestic OEM until August, Germany gained the #1 position from Norway this year. The growth, 49 % so far, was based on higher BEV sales: The new Tesla Model-3 contributed with 7900 units, Renault increased sales of the outgoing Zoe by 90 % to 8330 units, BMW doubled sales of the i3 to 8200, its battery capacity was increased to 42 kWh and gone is the Range Extender. The Mitsubishi Outlander PHEV (6700 units, +435 %) filled some of the voids left by Daimler, VW Group and BMW. The new Audi e-tron quattro, the Hyundai Kona EV and the Mercedes E300 PHEV added 3000 to 4000 units each.

The fastest growing markets, in terms of %, are the Netherlands and Ireland, both with focus on BEV sales. The UK and Belgium returned to growth with high Tesla Model-3 sales and the return of popular PHEVs.

Apart from the top-15, most other markets posted gains, too. Iceland, Slovakia and Slovenia being the few exceptions. In total, Europe plug-in sales increased by by 39 % until October.

2019 to end on a high note for Europe

Tesla’s position in Europe is not quite as overwhelming as it it in the US, where 4 out of 5 BEVs bought are from Tesla and the Model-3 stands for nearly half of all plug-in sales. Still, without it, EV adoption would be significantly slower in Europe. Of the 125 400 units sector growth until October, 65 600 came from the Model-3.

Q4 of this year will be special, with high pend-up demand for PHEVs from German brands and BEV sales being pulled ahead in the Netherlands, where the benefit in kind value for the private use of company cars increases from 4 % to 8 % of the list price; PHEVs and ICEs are taxed for 22 % of the list price. On top of that, Tesla needs to reach, or better, beat the guidance for global deliveries in 2019. 360 000 units were the lower end, which requires at least 105 000 global deliveries in Q4, “only” 8000 more than in Q3. December deliveries of Tesla Model-3 may reach 10 000 units in the Netherlands alone.

6 % share possible in December, higher than in China

Plug-in volumes and shares from January to October have been consistently above 2018. YTD, the increase is 39 %, share is 3 %, compared to 2,1 % for the same period of last year. Volume increased by 125 400 units, +128 000 for BEVs and minus 2600 for PHEVs.

Unless supply is constrained in Q4, plug-ins can reach 6 % of the European light vehicle market in December. For the first time since many years, this is higher than what we expect in China. For the European market of Passenger Cars and LCVs, we see only a slight decline of 0,2 % to 17,8 million units, not accounting for Russia, Ukraine, Turkey. Our best estimate for the year is 579 000 units and a plug-in market share of 3,25 %.

Share peaks in March, June, September and December relate to high Tesla deliveries at the end of each quarter.

Europe shines in an otherwise gloomy H2

Except for the 2015 boom and 2016 bust of PHEV sales in the Netherlands, EV adoption in Europe is a story of consistent volume increases. It follows our expectation of a general adoption trend, which is unlikely to follow a straight line, but rather the S-curve.

Weaknesses in PHEV portfolios and supply constraints of some BEVs have delimited plug in growth during the first 3 quarters of 2019. Also, there is this persistent rumour that traditional OEM hold back EV sales in 2019 to count them in 2020 sales for achieving the 2020/21 CO2 limits. We can’t see this in the recent numbers, but the year is not over, yet.

579 000 BEV+PHEV sales beat our expectations from earlier this year and give a year-on-year growth of 42 %, which a lot better than the declines we have seen in other regions during the 2nd half of 2019. China NEV sales are in free fall since July (check the China article for more info) and current US sales compare to the Model-3 boom of 2018 H2. Europe stands between growth and decline of global plug-in sales this year.

Close

Close