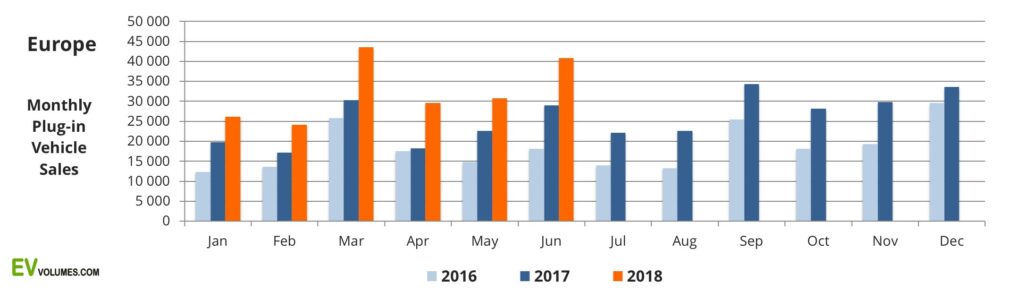

Plug-in vehicle sales in Europe reached 195 000 units in the first half of 2018, 42 % higher than for the same period of 2017. These include all Battery Electric Vehicles (BEV) and Plug-in Hybrids (PHEV) in Europe, passenger cars and light commercial vehicles. The plug-in share of the European light vehicle market reached 2,2 % in June and 2 % for the first half year. The trend, so far, indicates further increases around 40 % during the remainder of the year. 51 % of plug-in sales are pure electric vehicles (BEV) and there rest are Plug-in Hybrids (PHEV). Only 87 fuel-cell vehicles were sold during the period, up from 66 last year. With powerful Hyundai and Toyota behind them, the numbers speak for themselves.

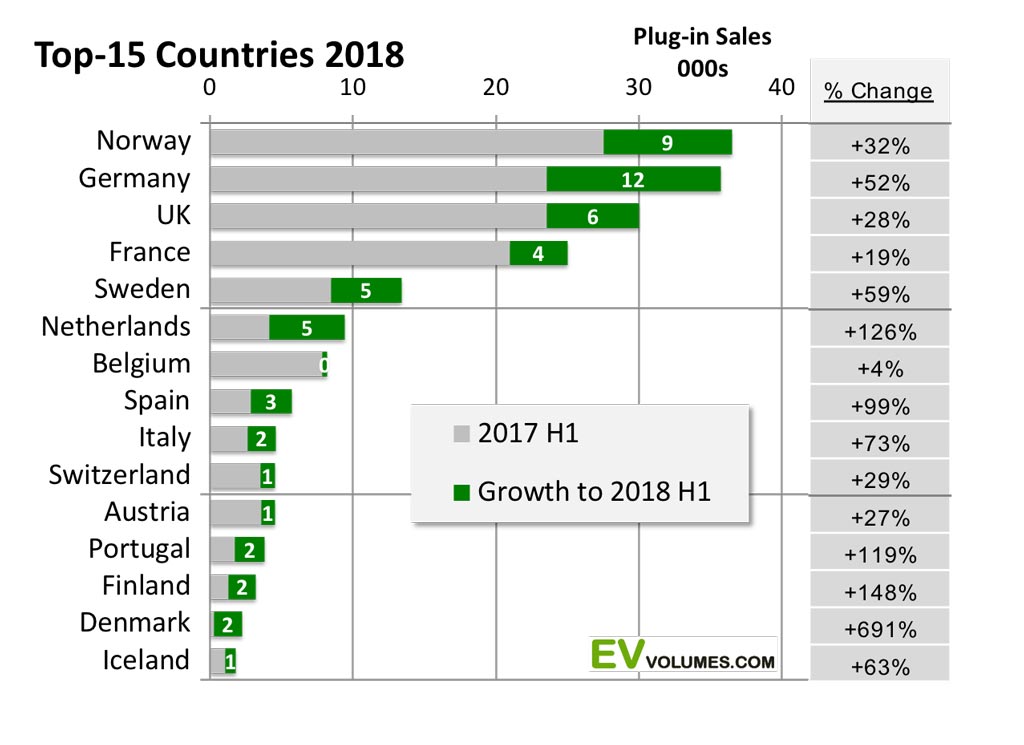

The German market is the strongest growth contributor, in terms of volumes. Even if growth rates do not reach 100 % as last year, this year’s 52 %, combined with the sheer size of the German market, push volumes forward. Norway is still Europe’s largest market for plug-ins, with a staggering share of 37 % in this year’s light vehicle sales. Counting passenger cars only, the share was 46,5 % in 2018 H1. A good indication of what is possible with compelling savings on vehicle taxes, much lower operating cost and a well developed charging infrastructure.

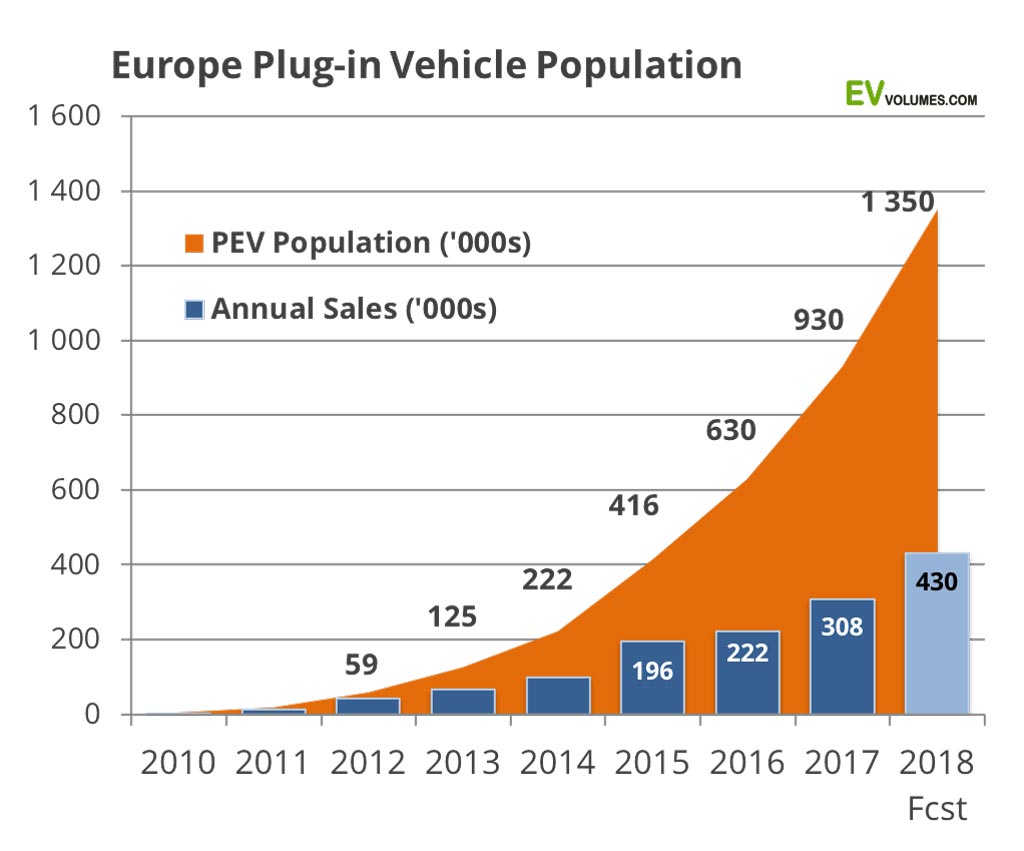

All Europe countries post growth for 2018 H1, many of them over 100 %, albeit still from low volumes. For the full year of 2018 we expect 430 000 plug-ins to be delivered in Europe, and a market share of 2,35 %. This is for the total of all EU and EFTA countries. The European plug-in vehicle fleet is now over 1 million and we expect the population to be 1350 000 units when the year ends.

Growth is everywhere this year

Norway still leads the European country ranking. 36 500 plug-ins were delivered including June and for the complete 2018 we expect 84 000 sales, a share of 45 % in Norway’s market for passenger cars + light commercial vehicles. Germany sales grow faster, though, and we expect it to take the volume lead in Europe with 88 500 registrations when 2018 is closed.

All Europe markets showed growth during the first half of 2018, though with varying pace. Plug-in sales in Netherlands and Denmark have turned around to rapid increases, following years of volume losses in adverse incentive schemes. France and UK continue with moderate increases as their domestic OEMs (PSA, Ford, Vauxhall) have less than compelling offers in the sector. Belgium has cut the incentives on luxury PHEVs and sales grew by a mere 4 %. All others have double or triple digit growth during the period, albeit from smaller bases.

In total, Europe plug-in sales grew by 42 %, compared to 2017-H1. Q1 increased 40%, Q2 by 45%. A caveat for high growth in the 2nd half is vehicle supply. Our tracking of plug-in vehicle inventory shows an average of only 4 days of supply on stock and 2 months of order back-log. Models with more than 10 000 unfulfilled orders, each, are Hyundai Kona, VW e-Golf, Jaguar i-Pace and Nissan Leaf and obviously the Tesla Model 3, all of them BEVs.

The Nordics lead in EV adoption

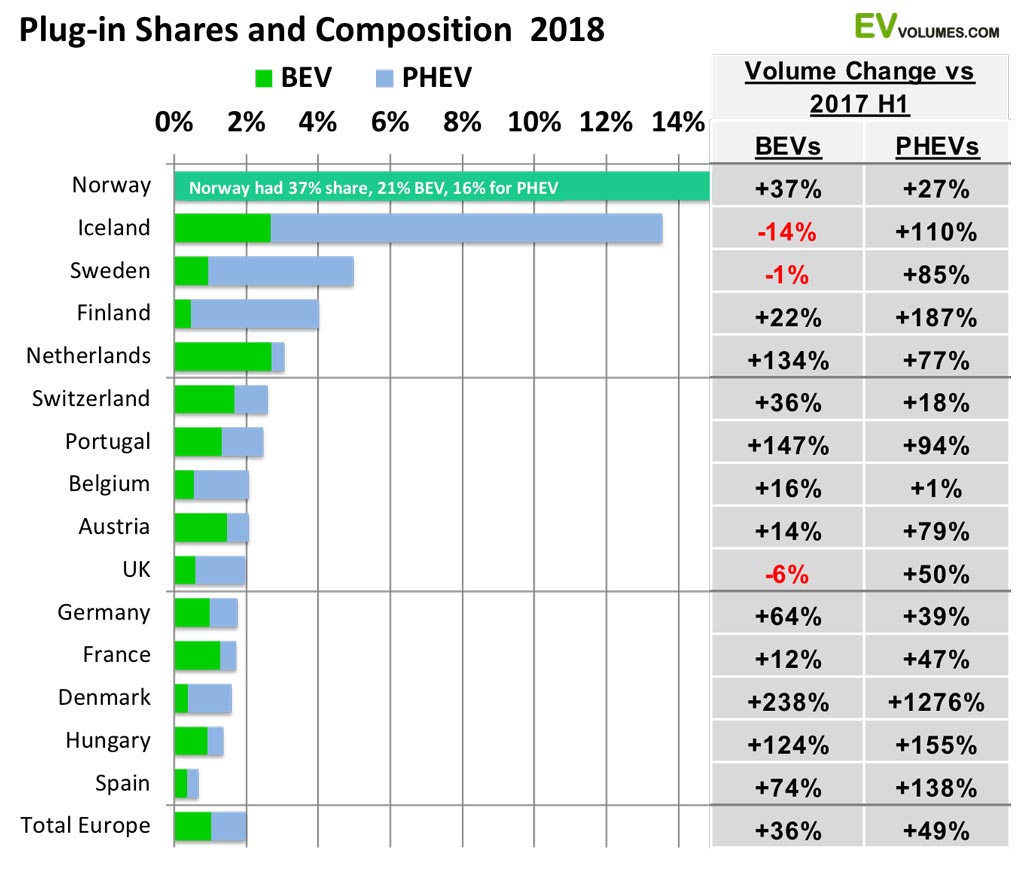

This diagram shows the share of Plug-ins among all light vehicles sold in a country and the composition of BEVs and PHEVs in the overall share.

Except in Denmark, where the market was confused by incomprehensible green car taxation plans, the nordic countries lead in EV adoption. The plug-in share in Norway is off the chart, as usual, with 37 % YTD. EVs have a long tradition in Norway (the Th!nk and Buddy microcars) and EV awareness in Norway started some years ahead of other countries. Thanks to clear, stable incentives in form of generous tax and toll savings, EVs have become the smart choice for light duty transport, despite long distances and a less than balmy climate. Low-cost electricity from 99 % hydropower helps, too. Iceland is in a similar position.

The mix of BEV vs. PHEV varies a lot between markets, highly depending on national incentive schemes. PHEVs captured more share compared to 2017, driven by the growing number of entries from German OEM. For 2018 YTD, 51 % of plug-in sales were all-electric in Europe.

PHEVs are the main contributor to high plug-in shares in Iceland, Sweden and Finland. It can be expected that future incentive schemes will reduce support for PHEVs and increase them for EVs. An example is the introduction of a tougher “bonus-malus” vehicle taxation system in Sweden from 1st of July. It created a swing of 10 % towards BEVs in the July registrations.

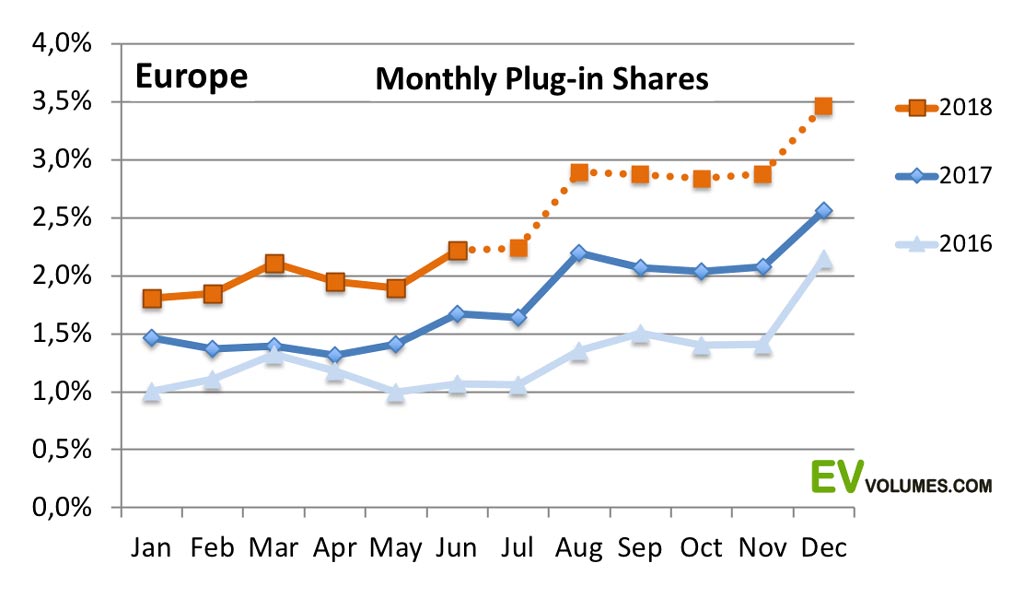

Market share development indicates 430k for 2018

Plug-in volumes and shares from January to June have been significantly above 2017. YTD, the share is 2 %, compared to 1,44 % for H1 of last year. Volume increased by 42 % during this period.

For the remainder of the year we assume the share development to continue on this trend and follow the seasonality of previous years. In a total market of 18 million light vehicles for 2018 (+1,9%), these shares convert to 430 000 units as the year-end result.

Supply may set limitations, especially for BEVs. Inventories are tight for most models and some have long waiting lists. Manufacturers have announced higher output for e.g VW e-Golf and BMW i3, but the situation for e.g the Hyundai Kona is still unclear, which could put a dent into Norway sales, where 7000 customers are waiting for it.

Exponential fleet growth

930 000 Plug-ins were on European roads at the end of 2017. Adding the 430 000 of 2018 and accounting for some scrapping, their number will increase by 45 %, to approximately 1350 000 at the end of 2018. With nearly 300 000 000 light vehicles on European roads, this means 0,45 % of them can plug in. A tiny share of the total fleet, but growing exponentially. The number of public charging locations does not keep pace anymore, we counted 80 000 public locations in Europe at the end of 2017 and expect they number to reach 100 000 by the end of 2017, a 25 % increase within a year.

Even if 80-90 % of all charging is done at home/work, BEV drivers in particular face several challenges when travelling longer distances, today: Finding the nearest station with the right connector type/power is one, having the station operators tag/card/app is the next, learning the unique operation routine is the third and the occasional malfunction is the forth. And then you have not even left the country yet. Range anxiety is amplified by charging anxiety and, unless public charging becomes easier and more reliable, it will restrict all EV adoption, except for Tesla. We can only encourage charging providers to unite on best practices and quality standards.

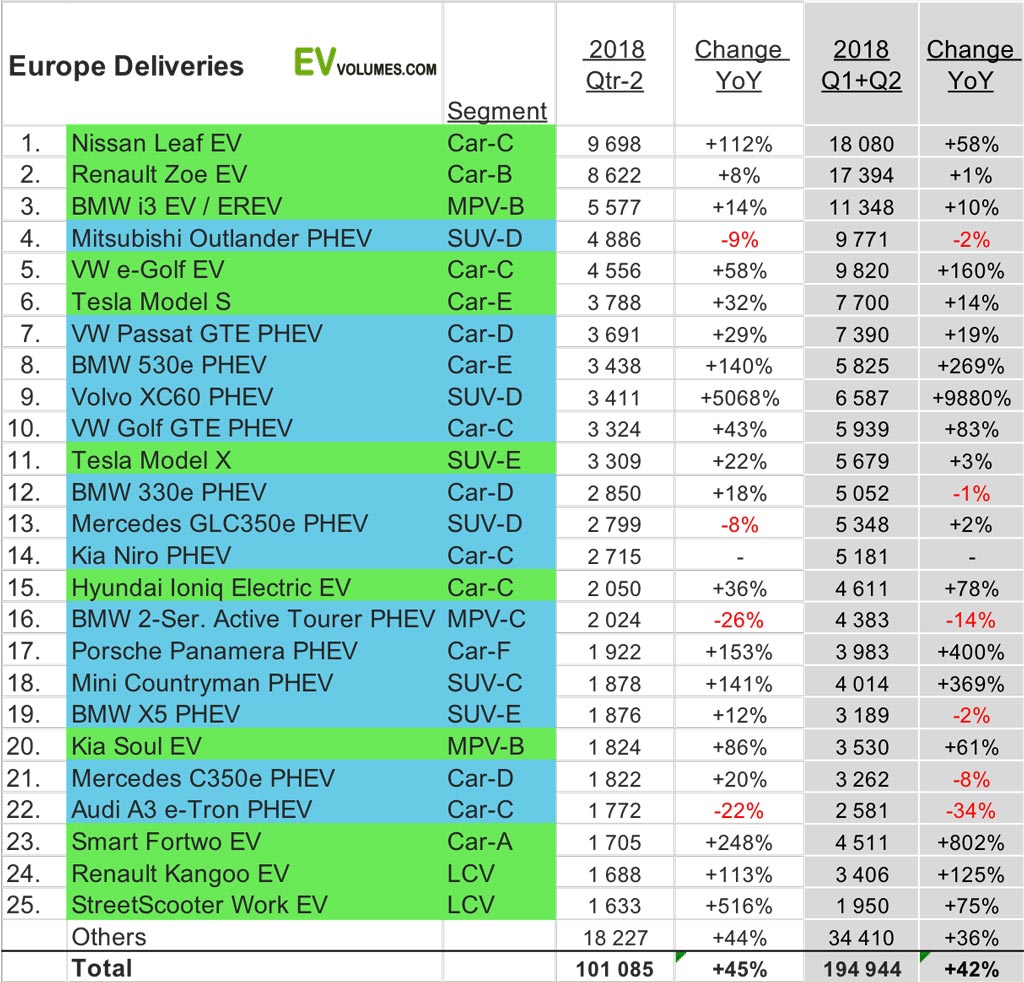

Change at the top and few losers

Unlike in USA, the new Nissan Leaf had a successful start in Europe and displaced the long term leading Renault Zoe from the #1 position. New and improved models definitely pay off, as the triple digit growth rates of Volvo XC60, Porsche Panamera, Smart and others can witness about. The new Volvo SUV gave the Mercedes GLC and the Mitsubishi a tough match last quarter. The Audi e-tron and BMW’s Active Tourer had facelifts and a related sales dips during Q1 and Q2, but volumes were back to normal in June.

Since June of 2017, the total number of models available in Europe has grown by 5 from 51 to 56. We tracked 27 BEVs and 29 PHEVs in June 2018. A good indication that the 42 % YOY volume growth is not just product driven. It is also the result of better awareness and insight, both, in the industry and among car buyers.

The top-10 manufacturer ranking after 6 months is #1 BMW 35 450 units +29 %, #2 VW 33700 units +44 %, #3 Renault 21 400 units +10 %, #4 Nissan 19 300 units +42 % and #5 Daimler 18 800 units +35 %. Growing fastest is #6 Hyundai-Kia with +234 % and #7 Volvo with 164 %. Mitsubishi (#9) is the only brand that lost volume (-3 %), Tesla is on #8 (the Model-3 sales start is not before 2019) and, finally, PSA is #10.

Close

Close