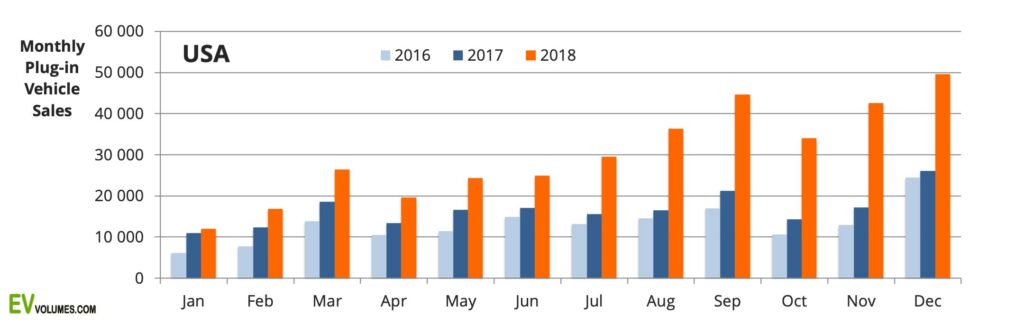

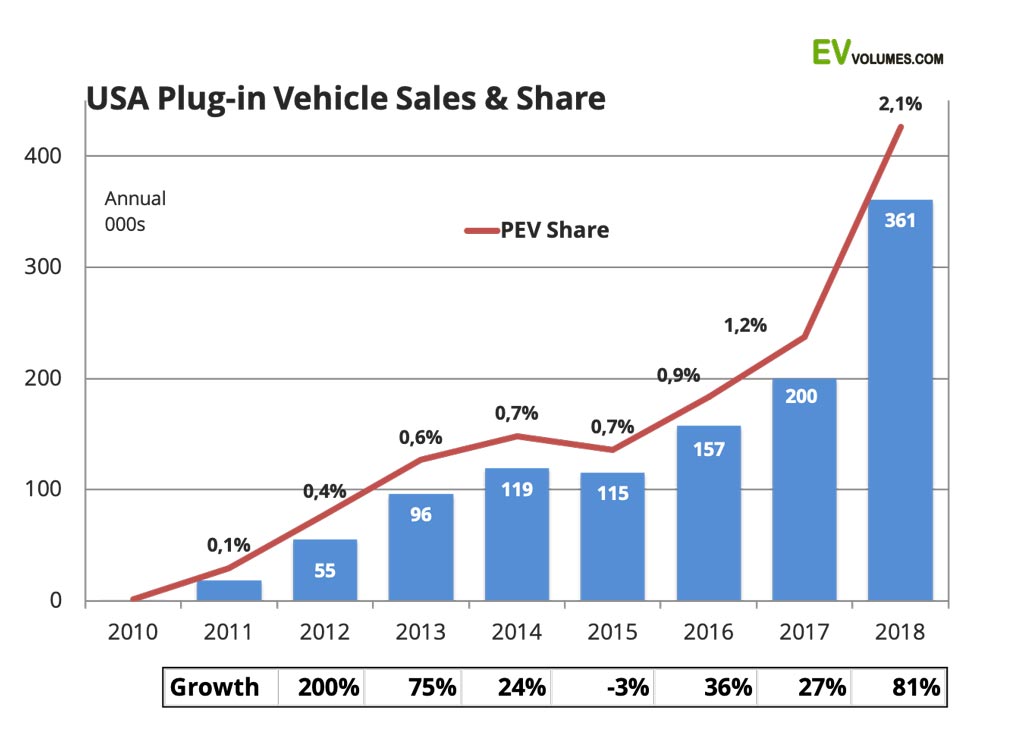

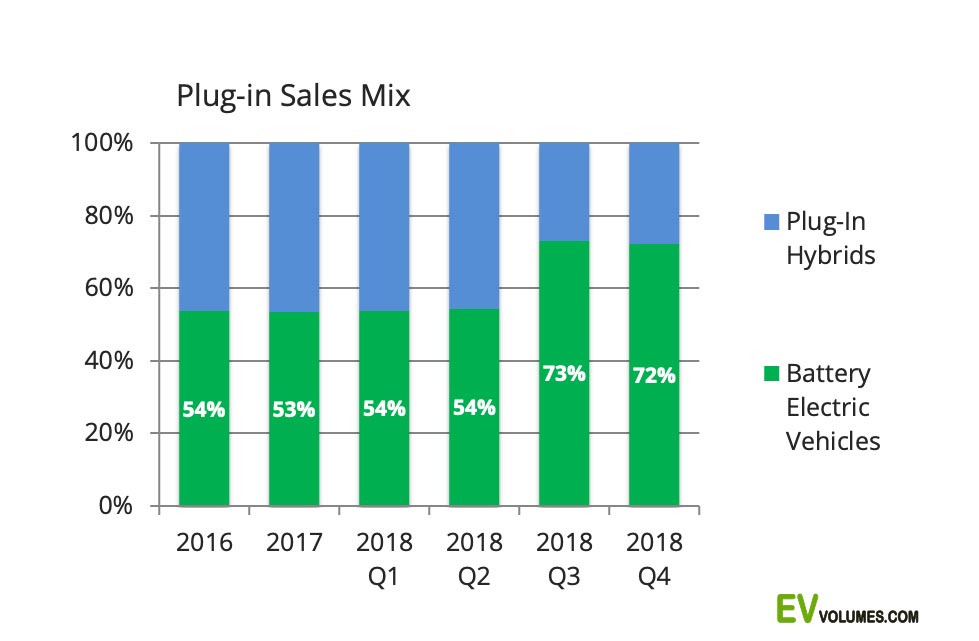

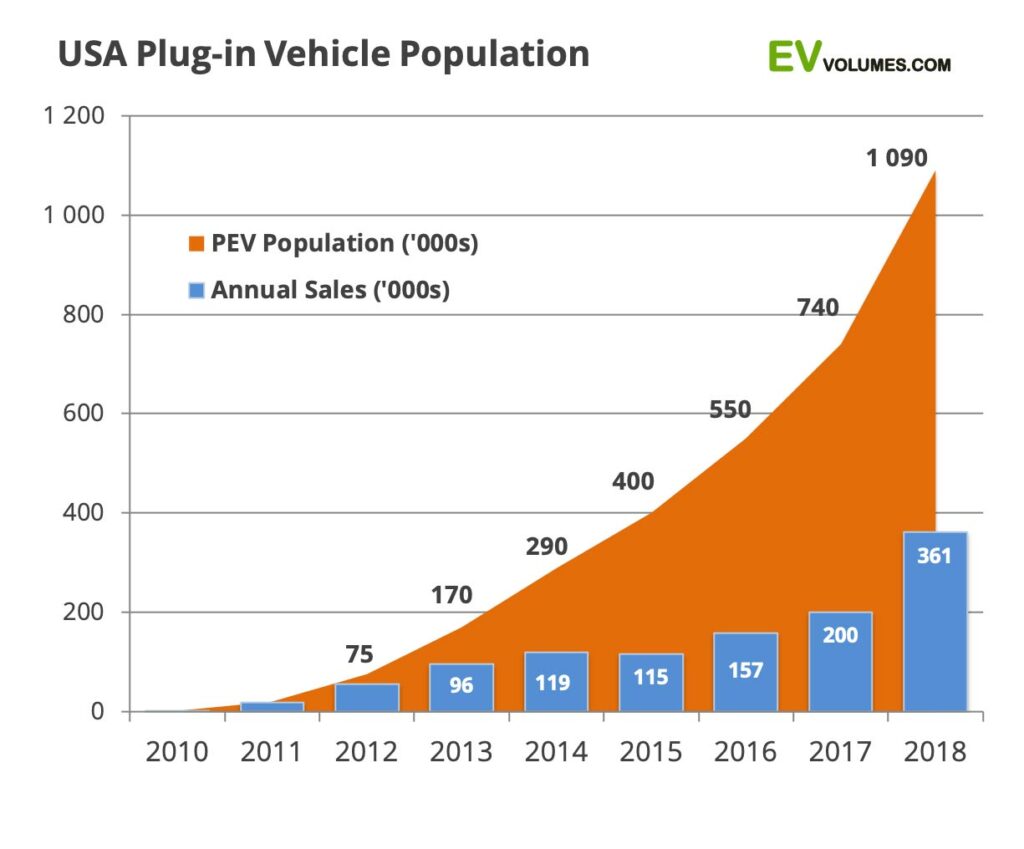

2018 was an exciting year for EV adoption in USA: 360 800 plug-in vehicle were delivered, 81 % more than in 2017 and the highest growth rate since 2013. Pure EVs (BEVs) gained most and represented 66 % of sales; 34 % were Plug-in Hybrids (PHEVs). In 2017 the ratio was 53 % BEV to 47 % PHEV. The plug-in share in the total light vehicle market reached 3 % in November and December and was 2,1 % for the entire year. The preliminary total for the US light vehicle market was 17,3 million, an increase of 0,5 % over 2017.

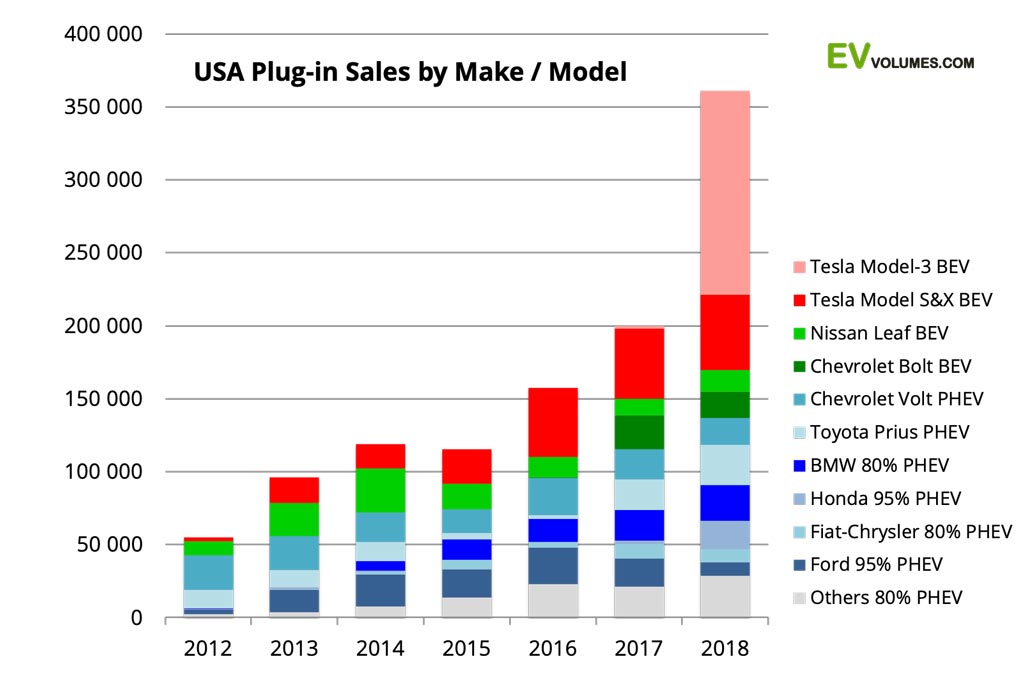

USA plug-in sales in 2018 were all about the Tesla Model-3: Plagued by ramp-up problems during the first half of the year, it became the worlds best selling EV of all categories in the second half, once output reached around 1000 units per day. Close to 146 000 units Model-3 were delivered to eagerly waiting customers in USA and Canada, 119 000 of them during the second half of 2018.

The new Tesla proved to be the game changer most of us expected it to be, not just shaking up the plug-in vehicle sector. The Model-3 has become a fully competitive alternative to well established ICE vehicles, now ranking among the 5 best selling cars in the US market. Among Mid Luxury cars in the comparable price bracket, the Model-3 captured 40 % of the segment during Q3 and Q4. A clear break-through and, deeming by the Tesla Q3 financial result, it can be done at a profit.

81 % growth of Plug-ins in 2018

USA made a huge leap forward in EV adoption in 2018. The growth rate of 81 % is comparable to 2011-2013, when the advent of the Chevy Volt, Prius Plug-in, Nissan Leaf and Tesla Model S created the first wave of rapid sales increases. It was followed by a 4-year period of moderate increases, even temporary declines. In 2018, the 2nd wave started and it is 4 times higher than the previous. The more remarkable, as it was just created by one new entry, the Model-3.

Plug-in sales are still concentrated on certain states: According to the Auto Alliance’s ZEV tracker, 50 % of USA plug-in sales were in California during the 12 month period ending Aug 2018. 12 % are in other states with ZEV mandates and 38 % are outside the states with ZEV mandates. The plug-in share varied as much as from 6,6 % in California to 0,2 % in North Dakota during the period. 2,1% on average for 2018 bring the US a lot closer to other, larger car markets, like Germany, France and the U.K.

The game changer

Since it started with volume production, Tesla has been the largest single contributor to EV growth in the US. Without the Model-3, the market had continued at the previous, leisurely pace. Its arrival is a game changer, raising the bar for plug-ins and ICE cars alike. The monthly sales volumes during the 2nd half were among the best sellers in the US car market, close to household nameplates like Toyota Camry, Honda Civic, Honda Accord and Toyota Corolla, all of them ICE driven.

Tesla now stands for half of the USA plug-in volume and, counting BEVs only, 3 out of 4 are from Tesla. The real impact on competition will become more visible when sales comprise more recent orders and less reservation back-log.

By contrast, the 2018 developments at Ford, GM and FCA are less impressive. Also, Nissan has not recovered from the Leaf “Rapidgate” yet. It had much higher sales during its 1st generation.

Gains and Pains in Q4

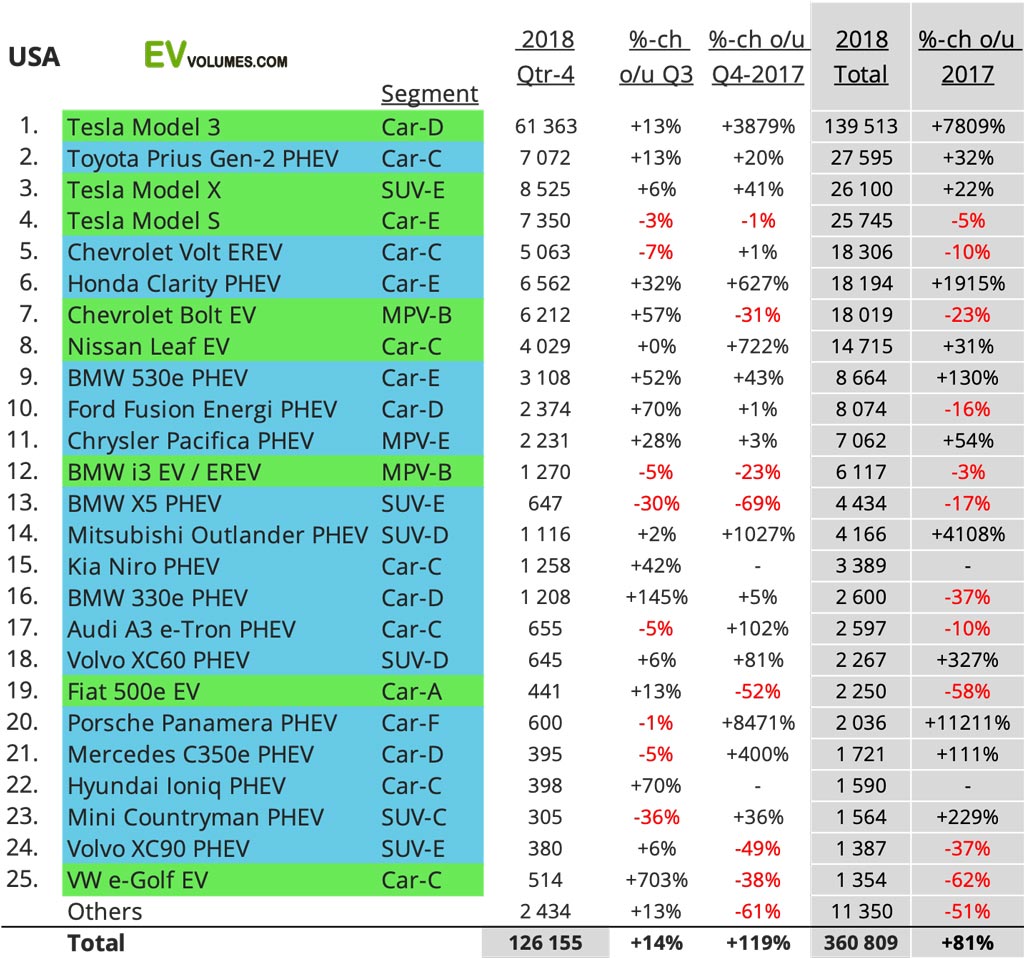

The table is sorted by the full year 2018 volumes this time. The #1 is no surprise, but how the sales numbers distance it from the rest is still impressive. In Q4 it sold 10 times more than e.g. the Chevy Bolt BEV. Moreover, Tesla came 1-2-3 in the BEV league with all their 3 models.

The Prius continues to be the best selling PHEV and increased by 32 % y-o-y. Two other PHEVs, the Honda Clarity PHEV and BMW 530e became instant successes.

The Bolt deserves better than a 23 % loss vs 2017 and in Q4 of 2018 it finally seems to recover. The Volt held up slightly better but will be scrapped in March 2019, to enable more focus on BEVs for GM. We still hope it will be re-born as a compact cross-over one day. US sales of the new Nissan Leaf look good compared to the run-out year of the old model, but remain sluggish and behind the volumes of the predecessor. It needs a better battery, soon to come.

Meanwhile, Ford’s ended sales of the Focus EV and the C-Max Energi, concentrates efforts on the Fusion Energi and seems to succeed. But the overall result was a hefty decline for Ford last year.

BMW lost volume on 3 of their models: the i3 got a larger, 42 kWh battery for MY2019 and deliveries have just started in the US. The 330e runs-out as the new 3-Series enters the market without a PHEV version for the first 9 months. Same for the new X5; the PHEV variant comes later in 2019 and with significantly improved specifications.

Fuel cell vehicles (3 models available) sold 2584 units during 2018, 12% more than 2017. Toyota delivered 1662 units Mirai. It would rank #22, but we don’t list the Mirai because it does not plug in.

Q4 sales for the other low volume imports are harder to comment, as their deliveries are highly influenced by the logistics of model-year introductions.

Mix shifts towards BEVs – but only to Tesla

The high volume of Model-3 sales during Q3 and Q4 has pushed the mix towards BEVs, which is a healthy development towards real zero-emission cars.

Excluding Tesla from the data reveals a disturbing fact, though: The sales of non-Tesla BEVs actually declined. 47 400 BEVs were delivered in 2018 which were not from Tesla; 16 % fewer than in 2017, when their number was 56600. PHEV sales remained less affected by Tesla growth and increased by 31 % during the same period. It clearly shows that the good is quickly displaced by the better. Long range and fast re-charge are still the key success factors for BEVs.

The EV population reached one million in October

The first million EVs on the road was reached in October this year. This is accounting for 1 % scrapping of totalled, worn-out and otherwise deregistered vehicles per year. Counting cumulative sales, the 1st million was already reached in September. At the end of 2018 the population was 1,1 million, nearly twice the number in operation in December 2016.

Our records show that the US stock now consists of 340 000 Teslas, 135 000 PEVs with ChaDeMo sockets, 100 000 BEVs with CSS sockets and 510 000 BEVs and PHEVs, which (except for the Mitsubishi Outlander) do not fast-charge.

Charging logistics remain an obstacle for most EV doubters, esp. when they lack access to charging at home or at work. Convenient and reliable fast-charging is the key to long-distance travelling. Tesla’s Superchargers have a good part in the brands sales success.

Close

Close