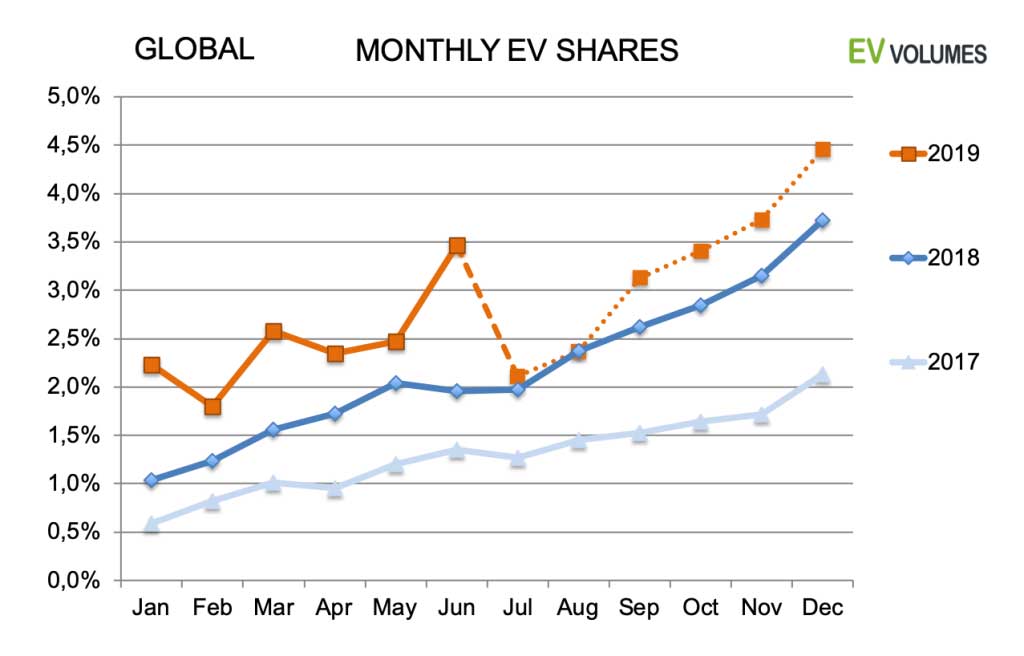

It includes all BEV and PHEV passenger cars sales, light trucks in the Americas and light commercial vehicle in Europe and Asia. Their share in the global light vehicle market was 3,5 % in June and 2,5 % for 2019 H1. 74 % of sales were all-electric (BEV) and 26 % were plug-in hybrids (PHEV), a massive shift of 11 % towards BEVs, compared to the 1st half of 2018. It was driven by the full availability of the Tesla Model-3, revised taxation/subsidy schemes and the Europe introduction of the more stringent WLTP (Worldwide Harmonised Light Vehicle Test Procedure) for CO2 emissions, all leading to higher demand for pure EVs.

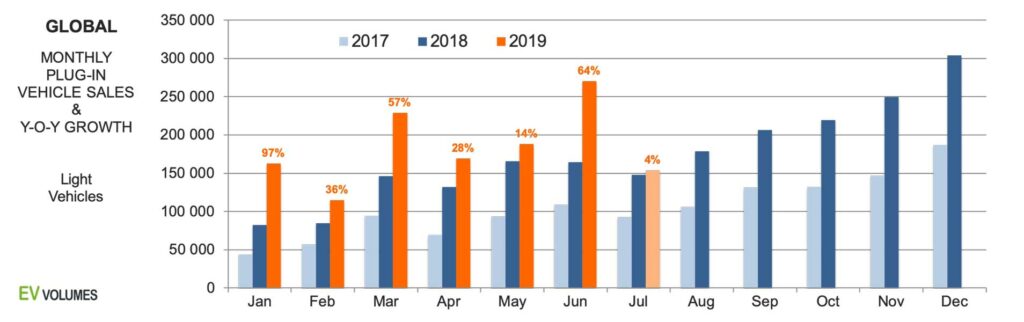

Preliminary results for the month of July show significantly slower sector growth than for H1, only 4 % globally. The two main reasons: (1) In July, revised subsidy schemes became fully effective in China, excluding vehicles below 250 km e-range and cutting subsidies into half for BEVs with longer range. NEV sales (New Energy Vehicles) contracted by 2 % in China in July, following 79 % growth in 2018 and 66 % in 2019 H1. We expect a decline for August as well, followed by a gradual recovery to growth rates of 30 % for the remainder of the year. (2) The US market increased by 89 % last year; most of the growth came from the Tesla Model-3 and in the 2nd half of 2018. Once escaping production hell, Model-3 deliveries were as high as they could get, covering the huge order back-log. Last years’ increase can not be expected for 2019, esp. when most brands other than Tesla sell fewer Plug-ins in the US than in 2018.

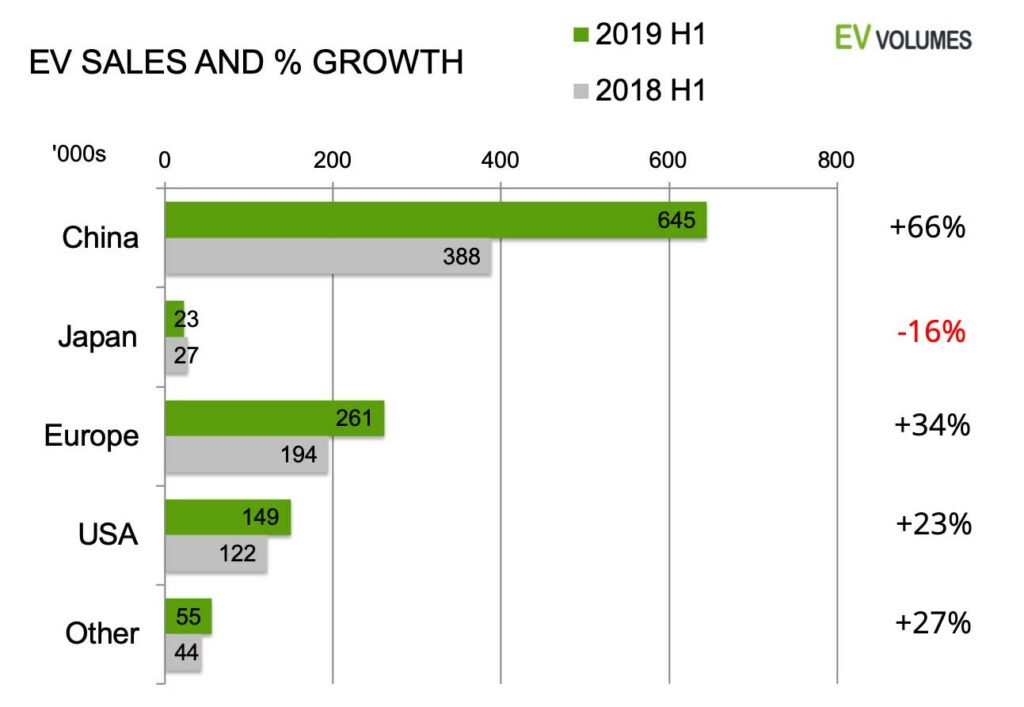

By its sheer volume, China is still the largest growth contributor, with 257 000 units (+66 %) added to a total of 645 000 units during the first 6 months. Europe growth for H1 was 34 %, +67 000 units, still held back by tight inventories, waiting lists for popular BEVs and the run-out of high-selling PHEVs. Plug-in sales in USA increased by 23 % in H1, +27 500 units, and with the Model-3 increasing by 45 000 units it means declining sales for many others. Among the fastest growing market with over 1000 units sales were Ireland (+183 %), Netherlands (120 %), Denmark (+86 %) and Poland (+81 %). Many markets in Southeast Asia have triple-digit growth.

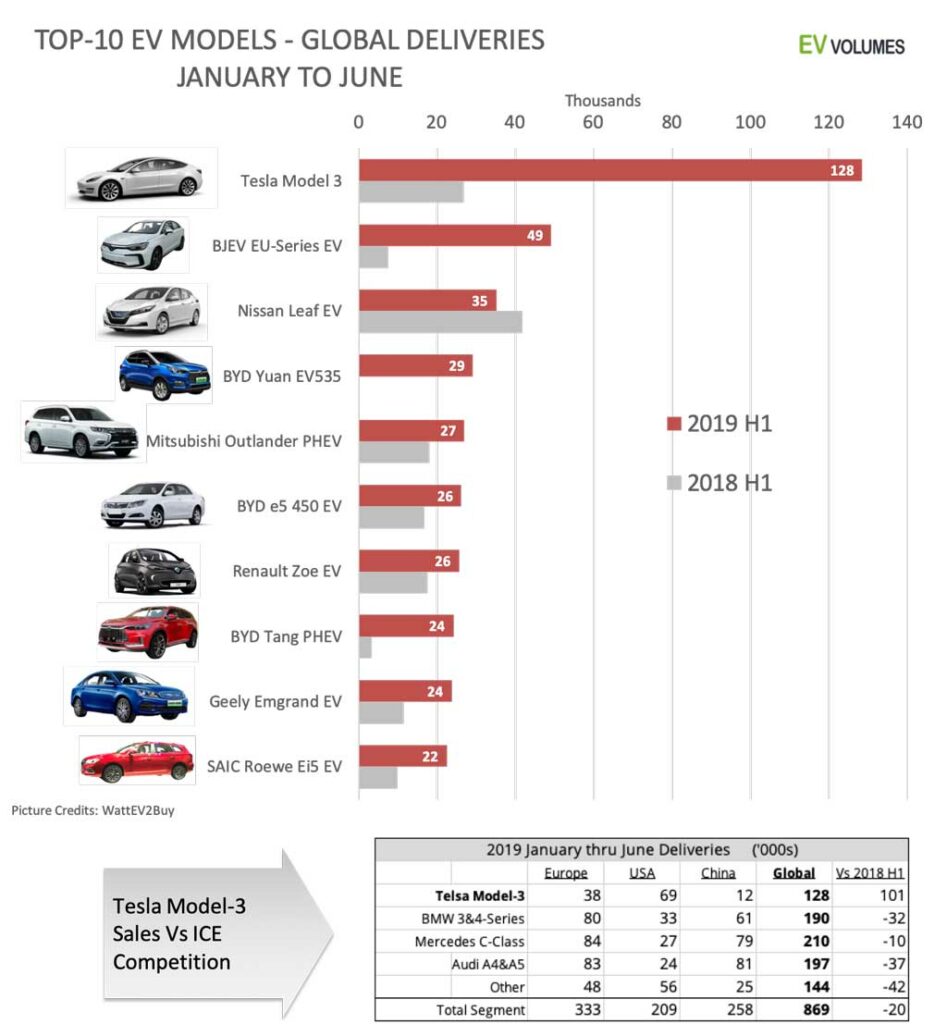

The share leader is Norway, as usual. Counting passenger cars only, 58 % of new car sales were electrically chargeable this year. Iceland comes 2nd with 18 % and Sweden 3rd with 11 % for 2019 H1. Our Europe story on H1 has more details on this, but please note that shares presented there, include LCVs, which drag the average shares down. Among the larger economies, China leads with a plug-in share of 6 %. Among other car markets with over 1 million total sales, Canada leads with 2,7 %, all others show 2,5 % or less for H1 combined. The best selling plug-in, by a wide margin, was the Tesla Model-3, with ca 128 000 units delivered globally during H1 of 2019. This puts it close to the leading ICE car models in the Mid-Luxury car segment, still carrying the handicap of import duties in the vast Chinese EV market. In the US it outsells the corresponding ICE entries of BMW, Mercedes and Audi by a ratio of two to one.

57 % of H1 Plug-in sales were in China

China has further advanced in the EV industry with 66 % more NEVs sold year-on-year in H1 and stood for 57 % of global plug-in sales. In June, the NEV share in all light vehicles sold was as high as 8,1 %. In contrast to booming NEV sales, the downturn in the overall car market continued. H1 light vehicle sales in China were off over 12 % compared to H1 of last year. ICE-only sales were down 14 %. On an annualised basis, the 2019 ICE volume is lower by 2,5 million units compared to the 2017 market peak, while NEVs gain nearly 1 million compared to 2017.

Losses in Japan are related to the decline of Toyota Prius Plug-in sales and the transition of the Nissan Leaf to the 60 kWh version. Also the #3 in the sales ranking, Mitsubishi Outlander, stayed just flat. Few bright points otherwise.

Europe CO2 test procedures and tax schemes have become tougher on PHEVs in several countries and it shows in the ratios of BEV to PHEVs sold. The BEV share in the mix increased from 51 % to 68 %. Volumes of BEVs increased by 79 %, while PHEVs lost 12 % versus H1 of 2018. The increases for total Europe was 34 %, but could have been higher with better availability of popular models. You find more info on the Europe results here.

Nearly all plug-in growth in USA can be attributed to the Tesla Model-3; many others were in reverse. The summary for the USA results is here. “Others” include Canada (26 900 sales so far, +24 %), South Korea (16 700 sales, +43 %) and many fast growing, smaller EV markets around the world.

Model-3 retains special status

As expected and still impressive, the new Tesla was the world’s best selling plug-in in H1 and by a large margin. Sales volumes approach those of premium competitors selling 300 to 400 000 units per year. Once production is localised in China, global volumes can be on par with the leaders in the mid-luxury segment.

Beneath the #1, the changes in ranking were many, compared to 2018: The BAIC EC-Series sub-compact stumbled over subsidy hurdles, lost over 30 000 sales and is now on place 38. Meanwhile, BAIC revived the EU-Series, a previous also-ran. It raised to #2 like a Phoenix. The Nissan Leaf retained the #3 position despite softening sales. The next 10 contenders all had sales of 20 to 30k for the first half year. Tesla was in that ballpark in H1 of last year, but lost plenty of volume on S & X this year and fell out the top-10. The BYD Yuan EV, a small SUV with 400 km e-range became an instant hit and sold 29 000 units in China since March.

The Mitsubishi Outlander PHEV is still going strong. With its relatively large battery of 12 kWh it stayed under the 50g CO2 limit even in the stricter WLTP. In Europe it was an attractive substitute for all discontinued PHEVs. The BYD e5 and Geely Emgrand BEVs are attractive in the fast growing ride hailing (like DiDi) business and gained further volume. The Renault Zoe climbed 3 ranks, even if it is replaced by the end of the year.

Note that only 2 out the top-10 are now PHEVs and they are both SUVs.

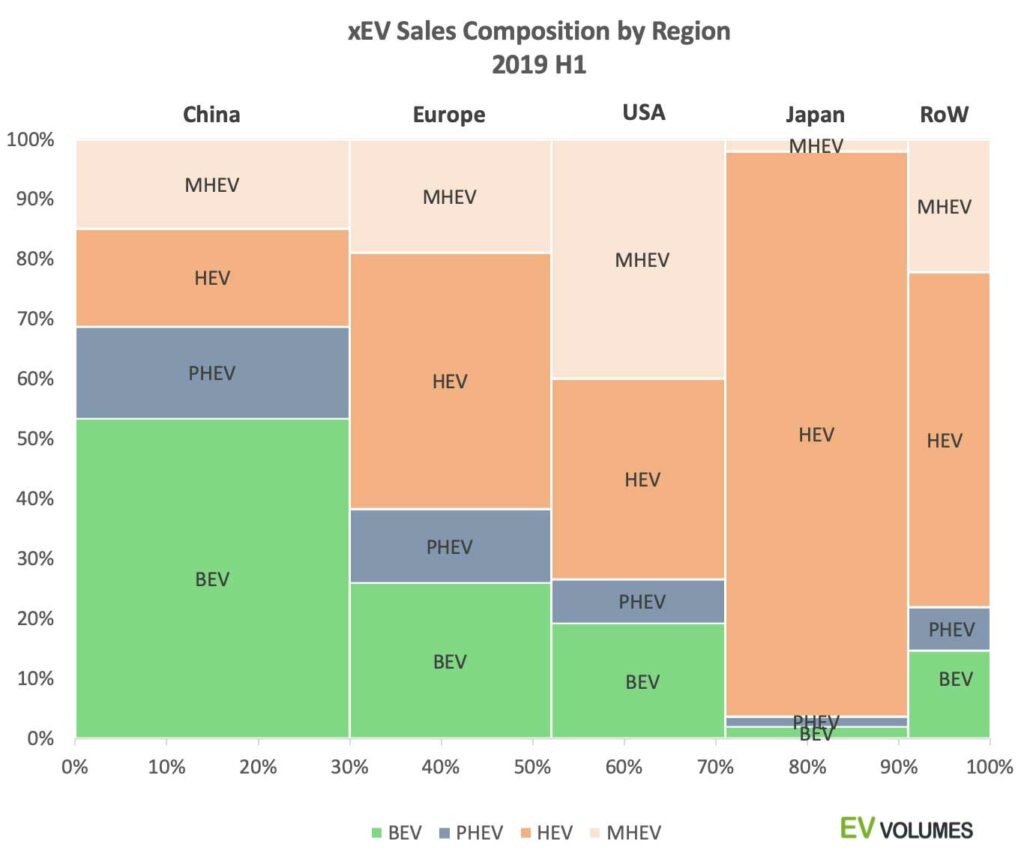

5 times more MHEVs within a year

Outside the Plug-in space a new breed of hybrids has entered the scene: So called Mild Hybrids, aka MHEV. They use an electric motor as engine assist and recuperate some kinetic energy during deceleration. They don’t charge externally and don’t drive all-electric (yet). Fuel savings are typically around 10 % versus a ICE-only car, but the technology has lower cost than for HEVs and is easier to integrate into traditional powertrains. MHEVs have become standard variants in many cases, esp. by German OEM and they sell in high volumes in e.g the Ram pick-up truck by Fiat-Chrysler. Counting passenger vehicles, the entire space of BEV, PHEV, HEV and MHEV had a volume of 3,05 million “xEV” sales in 2019 H1, BEV 820k, PHEV 296k, HEV 1370k and MHEV 564k . The map shows the split into geographies and concepts for the first half of 2019. Compared to 2018 H1 the changes are as follows: BEV +75 %, PHEV +4 %, HEV +16 %, MHEV +550 % and 51 % for all xEV together.

The Japan ties to HEVs remain exceptional: 89 % of all worldwide HEV sales are from Japanese brands, 43 % of all HEV sales reside in Japan and one in four car sales in Japan is a hybrid.

Japan is still slow to adopt plug-ins and MHEVs. The reasons are many: Solid leadership in HEV design and production is one reason. Lack of domestic plug-in choices is another: only 6 domestic models are offered, 3 of them (Leaf EV, Prius PHEV and Outlander PHEV) stand for 90 % of all plug-in sales; imports represent a small niche. Tax savings on eco-cars are similar for PEVs and the best HEVs. Only 5 MHEV variants are available and they appear pointless against over 70 HEV models with better fuel savings.

Plug-in growth is slowing down

Back to plug-ins, the 1st half of 2019 had healthy growth, +46 % y-o-y, even if the market share development has become unsteady. The peaks and valleys partly relate to high end-of quarter deliveries of The Tesla Model-3. The main reason is in China NEV sales, though. Subsidies were removed for EVs below 250 km e-range and cut in half for all other models. The transition period started in April and the new rules became fully effective in July. NEV sales were pulled ahead to March and June in anticipation of the tougher conditions.

Preliminary results for July show the full impact of the new scheme and the run on NEVs in June. For the remainder of the year we expect much slower growth in China. For the global growth trend this means a reduction from the 46 % we had in the first half to 15-20 % for the rest of 2019.

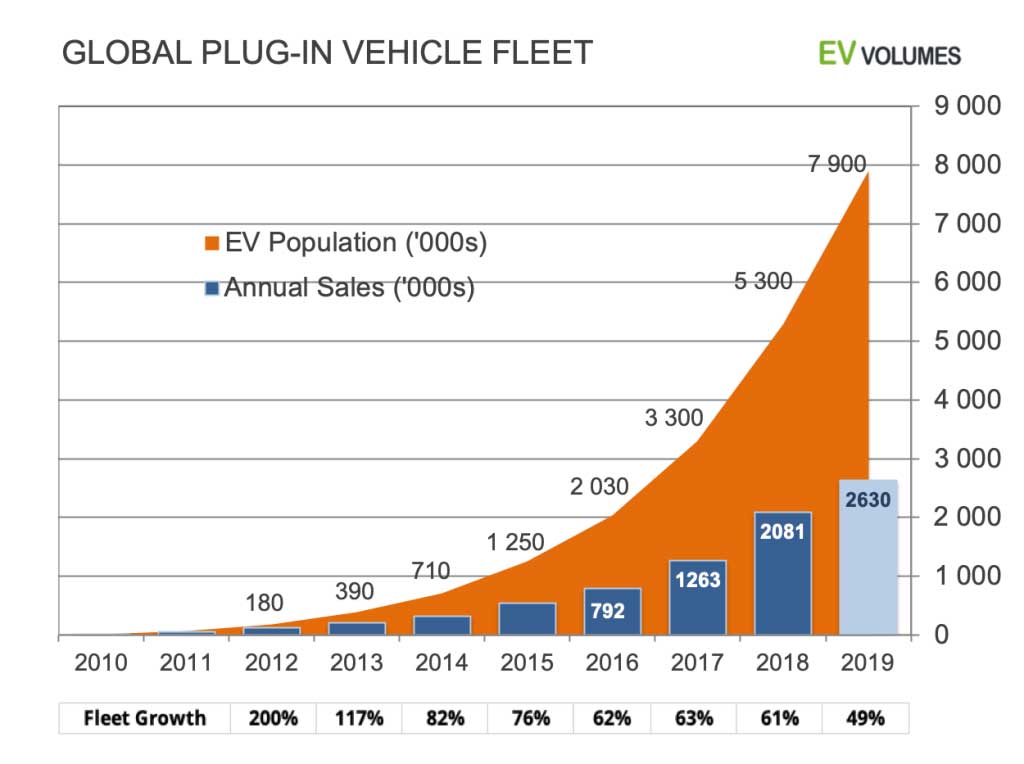

EV population: One in 175

For the entire 2019, we are expecting plug-in sales of 2,5 to 2,7 million units. This is lower than our previous outlook of 3 million and mainly relates to the subsidy cuts in China, which were more severe than announced in earlier policy plans. Also, PEV uptake in the US is abnormally weak for anything other than the Model-3.

In terms of global share it means 2,7 – 2,9 % for 2019, which is still 7 times higher than just 5 years ago. For details about the volume and share trend by region, please refer to our earlier H1 articles about USA and Europe, or contact us directly. Our next article will cover the Chinese market and its intricacies.

By the end of 2019, the plug-in vehicle population will reach nearly 8 million worldwide, an increase of 49 % over December 2018. With a global light vehicle population of around 1,4 billion, this is just 0,57 %, one in 175. Growth is exponential, though, and the overall picture will change much faster than historic sales suggest. Adoption of successful technology follows S-curves, not straight lines.

Close

Close