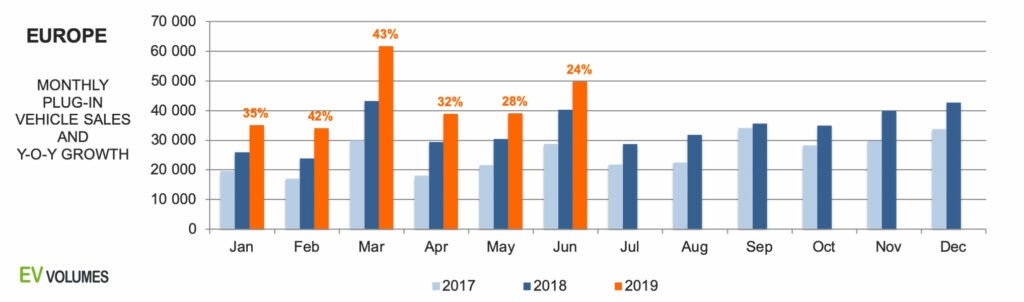

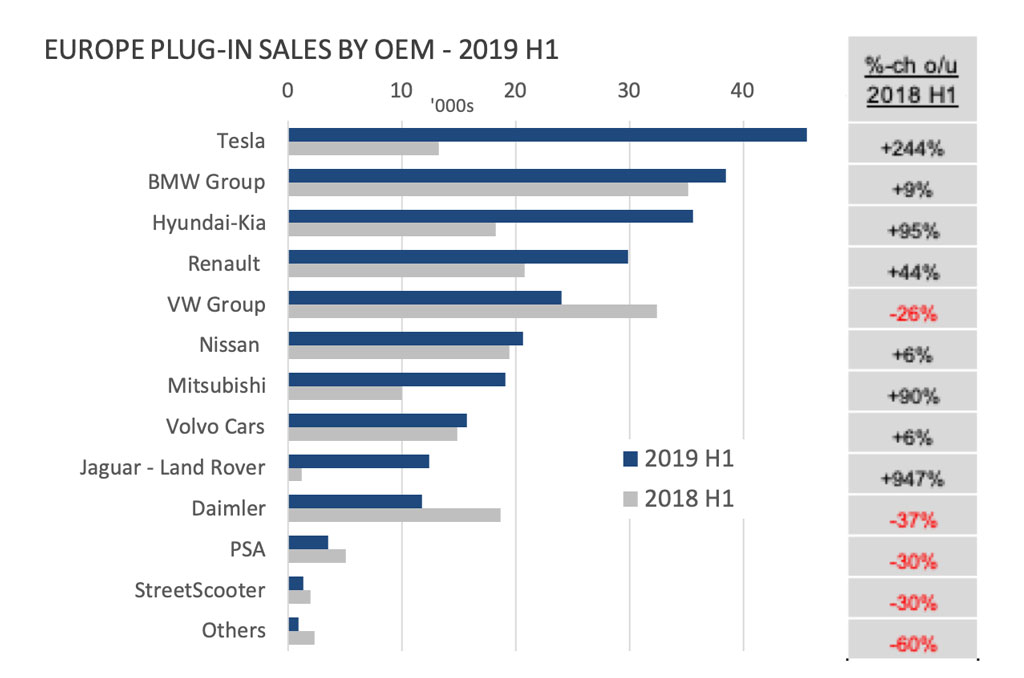

Plug-in vehicle sales in Europe reached 259 000 units in the first half of 2019, 34 % higher than for 2018 H1. These include all Battery Electric Vehicles (BEV) and Plug-in Hybrids (PHEV) in EU and EFTA countries, passenger cars and light commercial vehicles. The plug-in share of the European light vehicle market reached 2,9 % in June and 2,7 % for the first half year. The trend, so far, indicates an increases of 33 % for the entire 2019 to around 540 000 units. Demand and supply experiences a profound shift towards pure electric vehicles (BEV). While their share in plug-in sales was 51 % for 2018 H1, it has increased to 68 % for 2019 H1. The change reflects the introduction of the more stringent WLTP for fuel economy ratings, changes in taxation/grants promoting more BEV uptake and better supply of long-range BEVs. The hiatus in PHEV offers continued, with several popular model being upgraded with longer e-range for the 2020 model-year. Year-on-year, PHEV volumes actually declined, loosing 12 300 units (-13 %) during the first 6 months, while BEVs had 79 % more sales.The OEM ranking changed a lot, too, with Tesla becoming #1 by 38 000 Model-3 deliveries in H1. The Model-3 was the best seller in the sector posting 12 500 units more than the previous #1, the Renault Zoe. BMW, Volkswagen and Daimler suffered from pending upgrades of popular PHEV models, with deliveries starting in Q3 and Q4 this year. Winners were Hyundai-Kia, Renault, Mitsubishi and Jaguar-Land Rover.

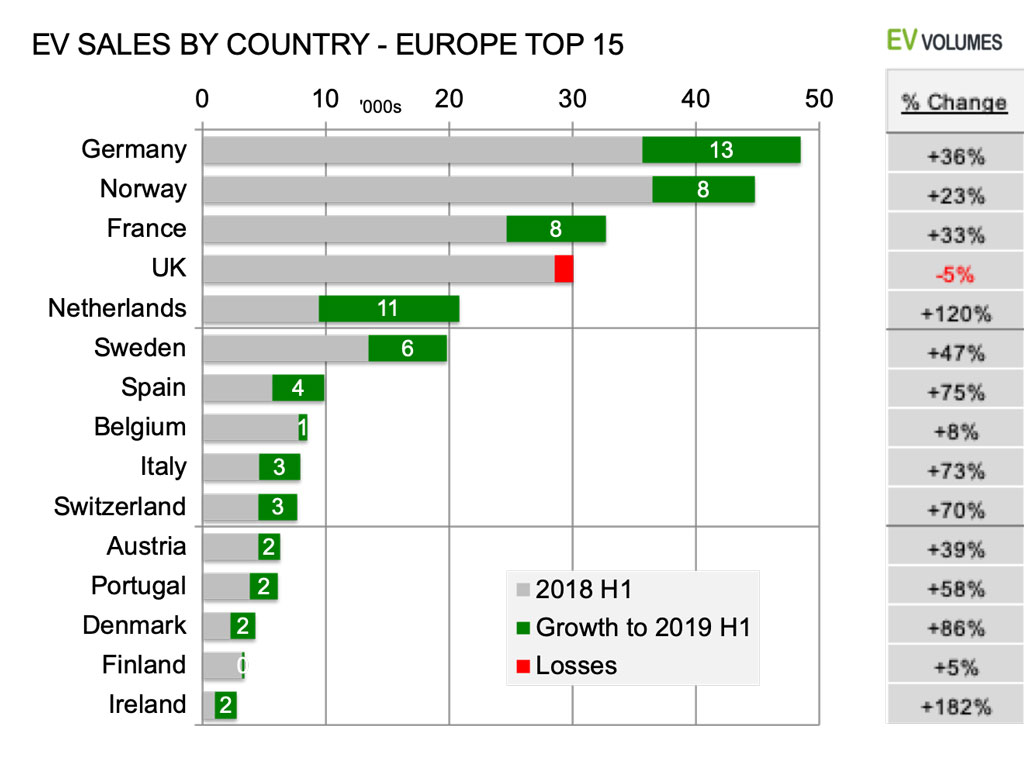

Germany and the Netherlands were the strongest growth contributors, in terms of volumes. Germany has become the largest market for plug-ins in Europe, displacing Norway to the #2 position for the first time. Norway is still the word leader in EV uptake, with a share of 47 % in this year’s light vehicle sales, up 10 %-points from 2018 H1.

Germany passes Norway in volume

Despite weak PHEV supplies from their domestic OEM, Germany gained the #1 position from Norway this year, even if it is by a small margin. It was a result of strong sales increases from the new Tesla Model-3 (5350 units), Renault Zoe (5550 units, +106 %), BMW i3 (4520 units, +84 %) and the Mitsubishi Outlander PHEV (4130 units, +520 %), which filled some of the voids left by Daimler, VW Group and BMW. The new Audi e-tron quattro and the Hyundai Kona EV, both not available in H1 of 2018, added 1800 units each.

Among the top-15 markets, UK is the only one in reverse this year. PHEVs lost their subsidies and BEV get 1000 GBP less than last year. The UK plans to set the BIK (Benefit In Kind) for company car taxation to zero for BEVs, starting in April 2020. This will postpone many BEV purchases to next year in the UK. Meanwhile, neighbour Ireland has become the fastest growing plug-in market in Europe.

Following more generous subsidies and helped by oddities like petrol truck driver strikes in Portugal, also Southern Europe markets showed strong and consistent volume increases. In total, Europe plug-in sales grew by 34 %, compared to 2018-H1. Q1 increased 40%, Q2 by 28%.

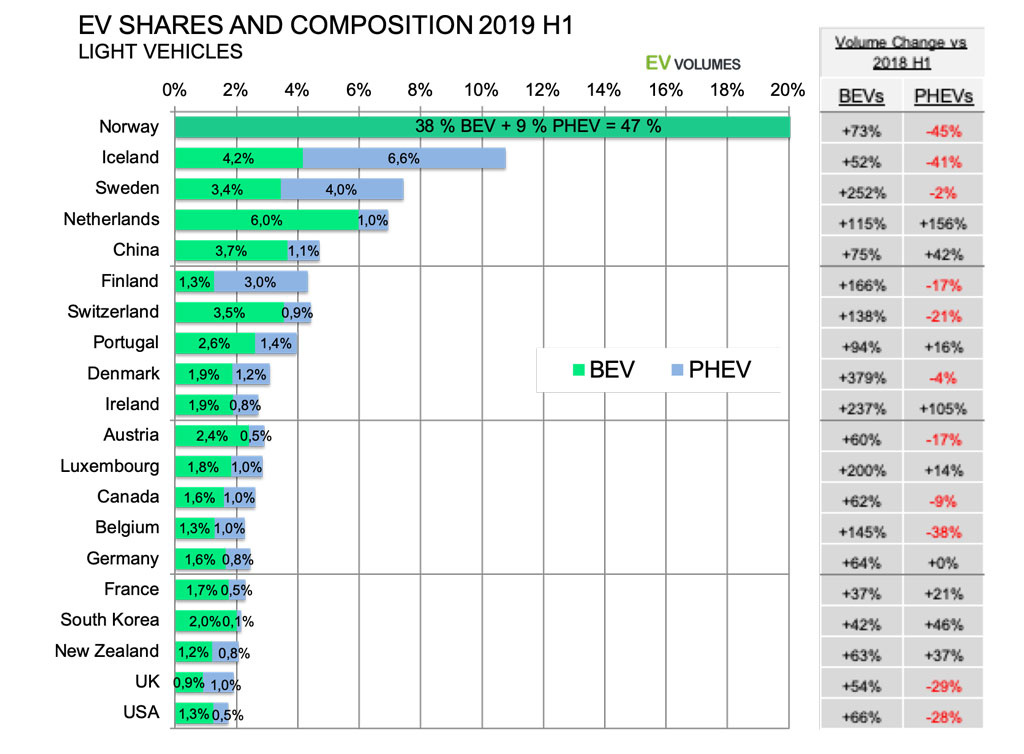

Shifting to pure electric

This diagram shows the share of Plug-ins among all light vehicles sold in a country and the composition of BEVs and PHEVs in the overall share. The %-columns to the right show the gains and losses for BEVs and PHEVs compared to last year in terms of volume.The mix of BEV vs. PHEV varies a lot between markets, highly depending on national taxation and incentive schemes. The recent developments in vehicle portfolios and vehicle taxation have caused a rapid shift towards BEVs in most countries. For 2019 YTD, 68 % of plug-in sales were all-electric in Europe, compared to 51 % in 2018 H1. For the first time, PHEVs have lost volume in Europe, from 95k in 2018 H1 to 83k this year. The WLTP introduction in September 2018 has hurt e-range and CO2 ratings of PHEVs, with lower green car incentives as a consequence.

As usual, Norway is off the chart, with 47 % share YTD and much more BEVs in the mix. The best selling car of all categories in Norway was the Tesla Model-3, with 13,5 % market share this year, so far.

German OEM suffer from PHEV losses

Tesla is the clear winner, following the Model-3 introduction in Jan/Feb this year, with 38 000 units delivered to 25 countries. Model S&X deliveries decreased from 13 200 to 7 800 units, but still.

Plug-in sales of VW, Audi and Daimler were hit hardest, with most of their popular PHEV models stricken from the price lists at the end of last year. The C-Class and E-Class PHEVs are back with new 300e and 300de monikers and larger batteries. The high-volume PHEVs from VW, Audi and Porsche should reappear during the second half of this year. Meanwhile, VW sold 32 % more e-Golfs and Audi registered 6 600 new E-tron Quattro BEV this year. The Mercedes EQC 400 BEV posed 260 units during the 1st six months.The BMW Group was less affected by the PHEV downturn, but lost the #1 in Europe plug-in sales. The 5-Series PHEV sales held up well, so did the 2-Serien MPV and the Mini Countryman. The PHEV versions of the recently renewed 3-Series and X5 will start to show up in the sales statistics of the coming quarter. Hyundai and Kia have partly solved capacity constraints and nearly doubled their sales. Their BEV volume nearly tripled compared to H1 of 2018. Renault is still going strong with the Zoe, Europe’s best selling plug-in of last year, even if the successor is around the corner. Nissan Leaf sales stagnated while buyers are waiting for the 60 kWh version.

JLR is quite new to the sector, with PHEVs on two Range Rover models and the Jaguar i-Pace, with 6100 rsp 6700 units for the first 6 months. In 2018 H1, JLR was still in ramp-up mode. PHEV pioneer Mitsubishi further increased sales of the Outlander, filling some of the voids left by VW and Daimler.

Half of Europe’s EV growth is from the Model-3

Plug-in volumes and shares from January to June have been 34 % above 2018. YTD, the share is 2,7 %, compared to 2 % for H1 of last year, volume increased by 65 400 units. More than half of this growth (38k) can be attributed to the Tesla Model-3.

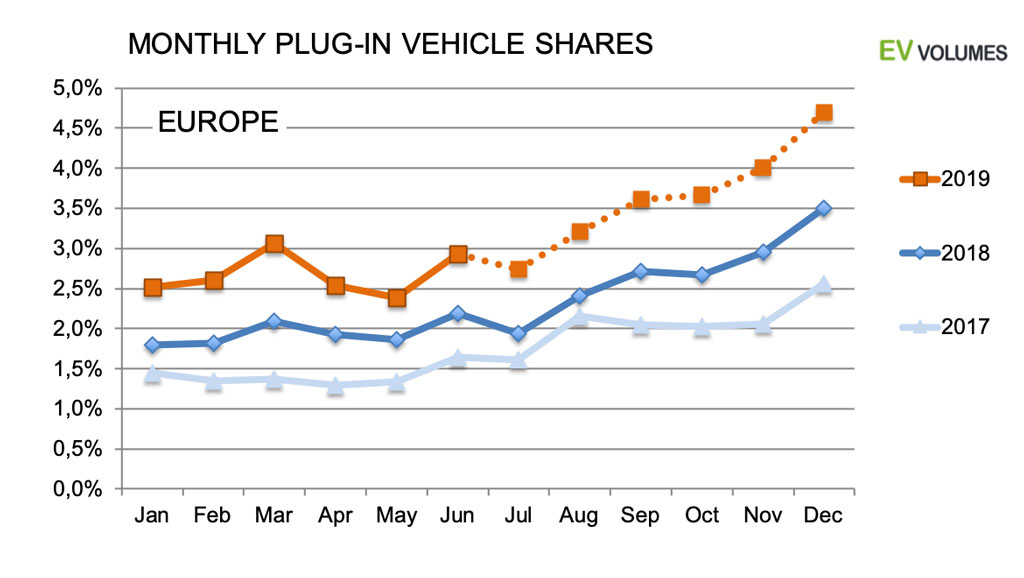

For the remainder of the year we assume the share development to continue on this trend and follow the seasonality of previous years. Plug-ins can reach over 4,5 % of the European light vehicle market in December and 3,1 % for the year. For the total market of Passenger Cars and LCVs, we expect a decline of 2,5 to 3 % to 17,4 million units, not accounting for Russia, Ukraine, Turkey. The 3,1 % convert to 540 000 units this year.

This assumes that the German OEM bring back improved versions of their popular PHEVs during the 2nd half of 2019 and steady supply of the Tesla Model-3.

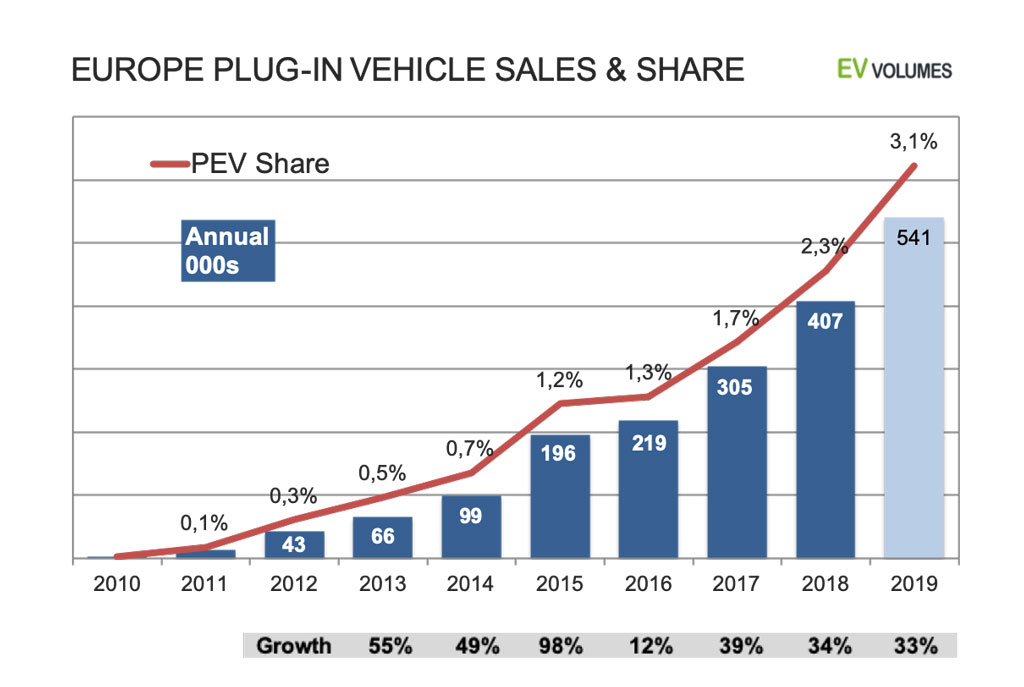

33 % Volume growth this year

Except for a special event, the 2015 boom and 2016 bust of PHEV sales in the Netherlands, EV adoption in Europe is a story of consistent and accelerating volume increases. It follows our expectation of a general adoption trend, unlikely to follow a straight line, rather an S-curve.Weaknesses in PHEV portfolios and supply constraints of some BEVs have delimited plug in growth somewhat during the last 12 months. During Q3 and Q4 of this year, OEMs have announced the sales start of over 25 new and improved models, 10 BEVs and 15 PHEVs, increasing the choice to 45 BEV and 50 PHEV models in Europe. Even if delays are to be expected, they will have a positive impact on demand and volumes during this year.

Our estimate is around 540 000 plug-in sales and a share of 3,1 % for 2019. We expect the ongoing erosion of Plug-in Hybrid sales to come to a halt in Q4 and the BEV-to-PHEV ration stabilising at 70:30 for this year and the next. PHEV volumes can increase again but we don’t expect a rebound of PHEV shares in the mix. BEVs have taken the lead, driven by new and improved products, plus the fact that they are more future proof in an environment where legislation and taxation becomes all more adversed to ICEs.

Close

Close