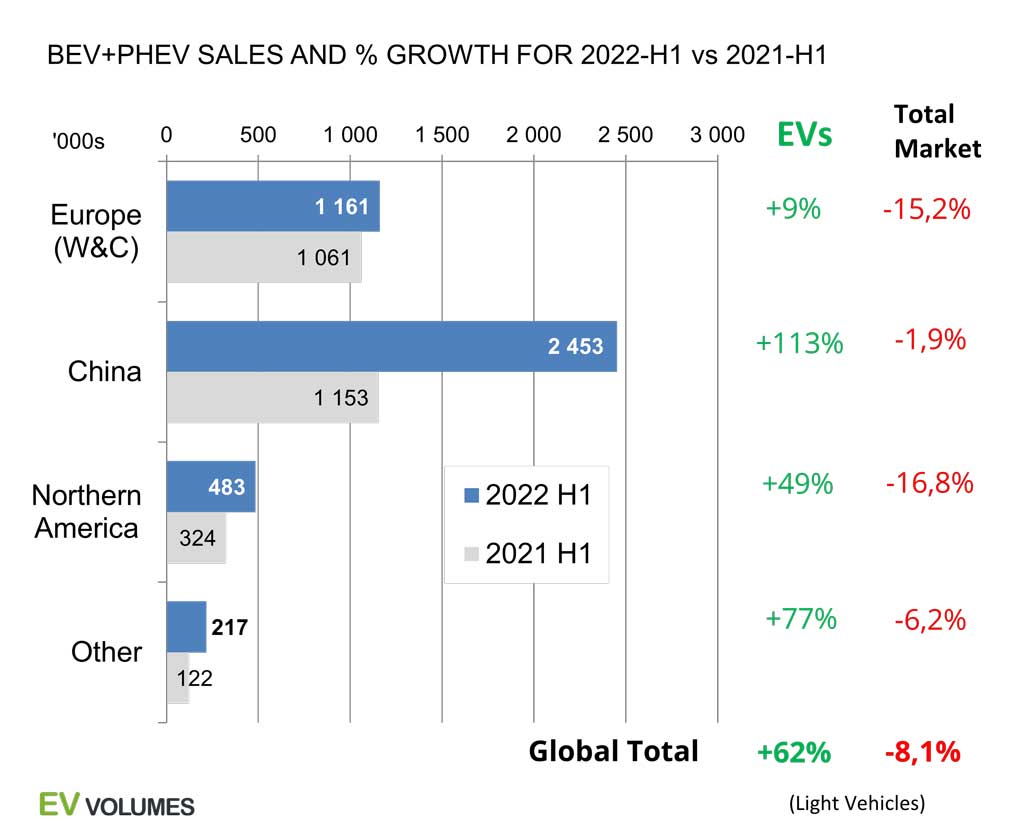

Global EV sales continue strong. A total of 4,3 million new BEVs and PHEVs were delivered during the first half of 2022, an increase of +62 % compared to 2021 H1. The regional growth pattern is shifting, though. Following 2 years of steep sales increases in Europe, EVs gained only +9 % over 2021 H1 there. Weak overall vehicle markets and persistent component shortages have taken their toll, exacerbated by the war in Ukraine. EV sales in USA and Canada increased by 49 % for H1 year-on-year, despite a weak overall light vehicle market which plunged by 17 % during H1 y/y.

China NEV sales defied all challenges the country is facing otherwise (real estate crisis, Covid lock-downs) and increased by a staggering 113 % for H1. BYD more than quadrupled sales to 641 000 units, making it the #1 in the global sales ranking, if their 315 000 PHEV sales are included. Counting BEVs only, Tesla still leads by a wide margin with 565 000 units delivered in H1.

PHEVs stood for 27 % of global Plug-in sales in 2022 H1 compared to 29 % in 2021. While their sales volumes still increase, their share in the PEV mix is in decline, facing headwinds from incentive cuts and improving BEV offers. Sales growth is increasingly depending on the degree of electrification. While BEVs grew by +75 % and PHEVs by +37 %, non-chargeable Full Hybrids grew by +14 % and Mild Hybrids backed by -7 % y-o-y H1. ICE-only vehicle sales declined by -16 %. Total global light vehicle sales were down 8 % y/y for H1-2022.

Rapid EV adoption in weak auto markets has boosted EV shares further. BEVs (8,2 %) and PHEVs (3,1 %) stood for 11,3 % of global light vehicle sales at H1 close, compared to 6,3 % in 2021 H1. Norway had the highest market share of EVs in H1 (BEV 69 % + PHEV 8 %), China had 21 %, Europe 18 % and USA 6,5 %. The fastest growing markets were India with 20 700 units BEV & PHEV for H1, +273 % and New Zealand with 8 300 units, +260 %.

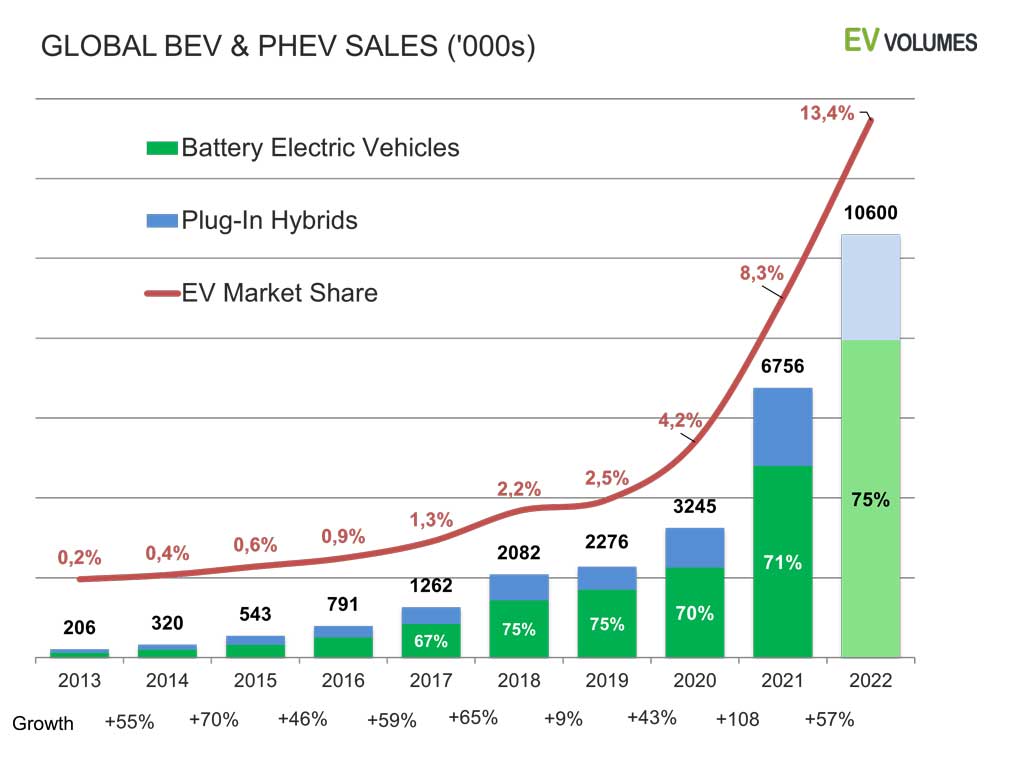

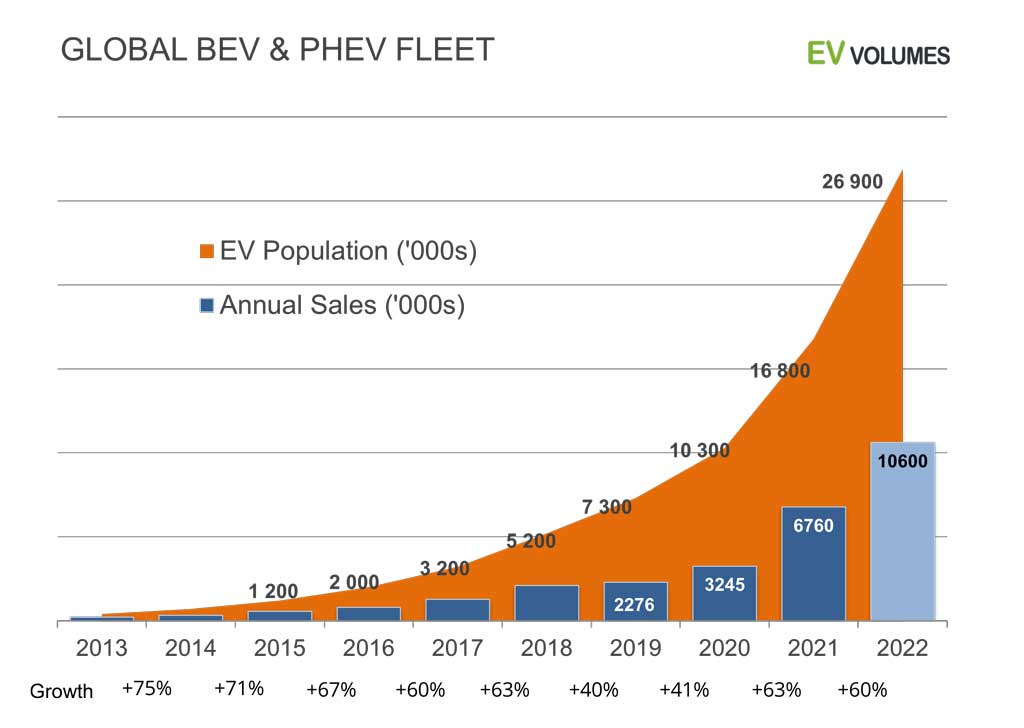

For the full year of 2022, we expect sales of 10,6 million EVs, a growth of 57 % over 2021, with BEVs reaching 8 million units and PHEVs 2,6 million units. By the end of 2022 we expect nearly 27 million EVs in operation, counting light vehicles, 70 % are BEVs and 30 % PHEVs. Sales of Fuel Cell Vehicles (FCEV) in the light vehicle sector have declined by -9 % so far and are below 20 000 units annually. Current sales are from 5 vehicle models and most sales are in South Korea and USA. We estimate their current population to ca 55 000 units.

High EV Growth in Weak Vehicle Markets

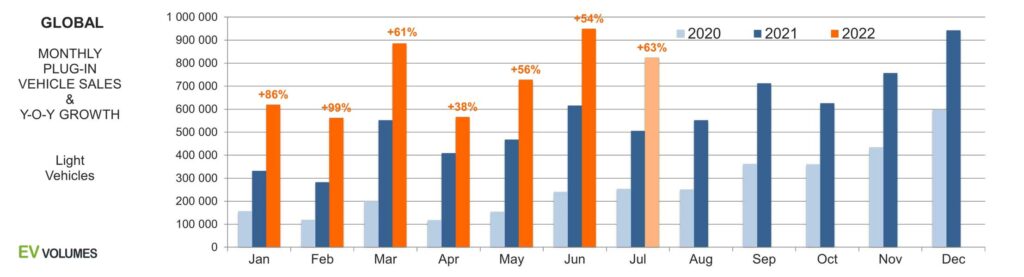

Global light vehicle markets are contracting again. Following a brief recovery in 2020 H2 and 2021 H1, 2022 H1 sales were 8,1 % lower than last year. We expect small gains for H2 as numbers compare to the depressed sales of 2021 H2. 2022 auto sales in most mature markets stayed 20-30 % below the 2015 – 2019 average, so far.

China is among the few exceptions, but with extreme volatility: a +24 % increase y/y in February was followed by a -45 % crash during the April lock-downs and a +30 % boom in June and July, amid swift Government support.

Western auto sales are facing a double dip, post-Covid, with supply constraints soon to be joined by demand constraints as central banks try to combat inflation by interest rate hikes. The result is, much likely, a further delay in market recovery.

EV sales held up well in this environment: while global light vehicle sales lost -8,1 %, BEVs and PHEVs increased by +62 % for H1. The relative weakness in Europe’s EV growth relates to the EV boom in 2020 / 2021 and the repercussion from the war in Ukraine.

New all-time-highs in EV sales will be common also during the 2nd half, but growth rates will be somewhat lower as the low-base-effect diminishes.

BYD Leads – Including Plug-in Hybrids

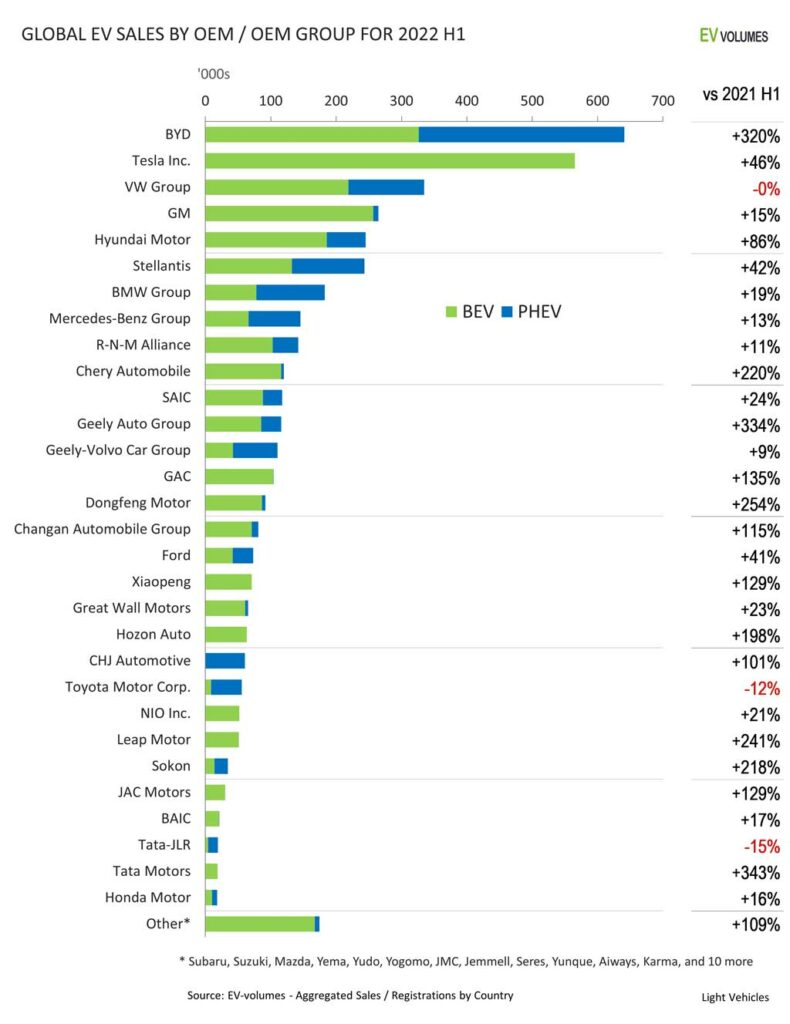

Robust increases of EV sales enabled nearly all OEM to grow their sales in 2022-H1. Global EV deliveries increased by +62 % y/y in total; OEMs with higher growth have increased their share in the EV sector.

BYD sold over 4 times as many BEVs+PHEVs compared to 2021 H1, by boosting sales of existing models, successfully introducing new models and by entirely focusing production and sales on BEVs and PHEVs. Non-chargeable variants were phased out, ending in April this year. BYD is now the largest maker of PHEVs and moved from rank #3 in 2021 to #1 for BEVs & PHEVs combined.

Tesla leads global sales of BEVs by a large margin, with a share of 18 % in all BEVs sold worldwide. H1 growth was 46 %, less than for the sector, but from a high base.

The VW Group stayed flat compared to last year; with all its brand following this pattern we can assume production related issues. BEVs gained, while PHEVs lost.

GM increased by just 15 % as the Wuling Mini-EV is facing more competition and most future, high volume EV entries still are in the pipeline.

Hyundai and Kia launched at least 9 new and revised EVs during the last 18 months, among them the Ioniq 5, the Kia EV6, the Kia Niro and 3 EVs from Genesis. Their global growth outperforms the sector and is the more impressive as the companies EV presence in China is fading.

Increases of Stellantis were below the global EV sector growth, with high exposure to slow growing Europe and low sales in the strongest market, China. Excluding China, their sector share has risen from 11 % in H1-2021 to 12,7 % this year.

Other OEMs of European and/or Japanese origin did not keep up with the sector growth as they were held back by disturbed supply chains and/or underestimated EV demand during weakening auto markets. Toyota and Jaguar Land Rover delivered fewer EVs compared to last year.

Most Chinese brands show triple digit growth of NEV sales in their booming home-market. Exports accounted for only 3,6 % of their global volume, not including China exports by e.g Tesla, Polestar, BMW iX3 and other transplants. Including these, exports accounted for 8,4 % of China NEV production in H1 this year.

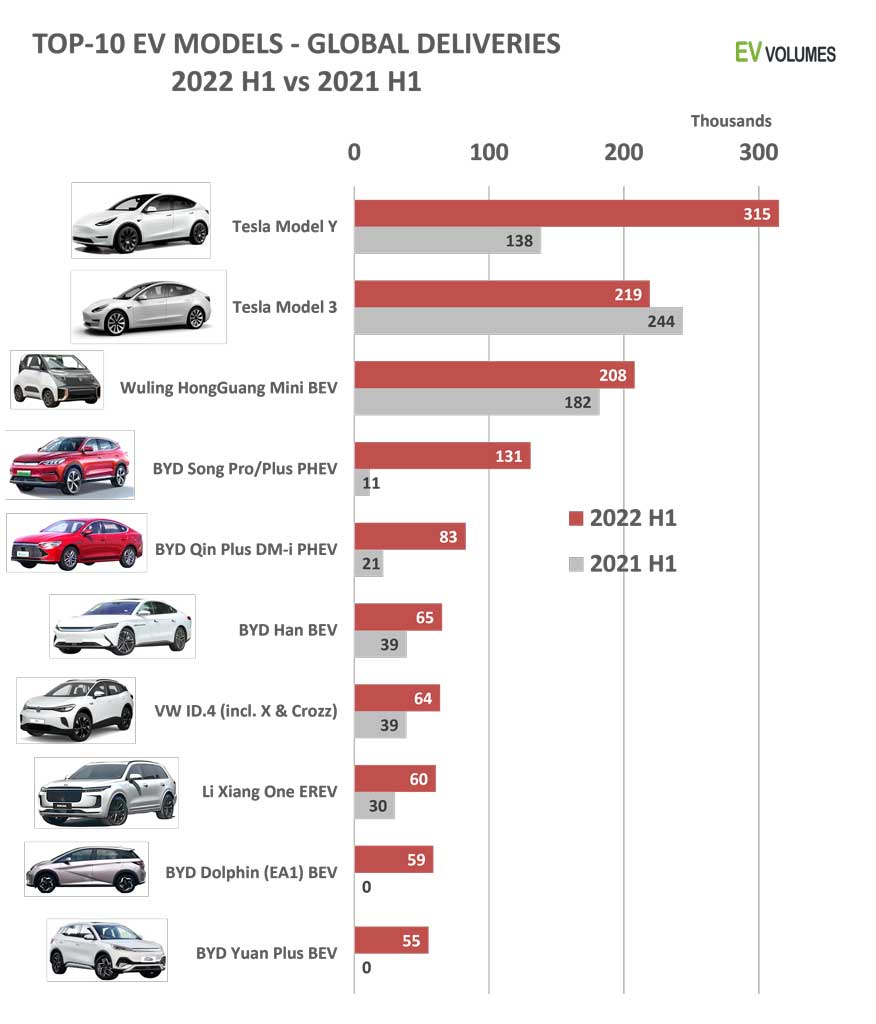

Tesla and BYD Models Dominate the Top-10

Tesla has a new best-seller, the Model Y, not only in the EV sector, but within all SUVs and Cross-Overs in this category, including ICEs. Household nameplates like Toyota Highlander, Ford Explorer, BMW X3, Mercedes GLC and the likes usually sell 300-400 000 units per year globally. The Model Y can comfortably reach 700k this year with current selling rates. The Model-3 took a beating, though, as Tesla prioritized production of the more sought after and more profitable Model Y.

BYD has 5 models in the top-10, with 2 PHEVs as their best-sellers; a legacy from their regular ICE business which BYD abandoned in April this year. The newcomers Dolphin and Yuan Plus had a flying start.

GM-Wuling’s Mini EV sales increased further with additional battery variants but it now faces more competition from similar concepts like the Chery QQ and other ultra-cheap mini commuters.

The BYD Han is a large sedan for a base price of 230 000 RMB. It carries BYDs new LFP Blade Batteries. With its generous size-feature-price ratio it has a unique position in the market. There is also a PHEV version selling ca 1/2 of the Han BEV volume.

The VW ID.4 is the best selling model from a European brand. Sales include the ID.4 X and ID.4 Crozz made by VW’s joint ventures with SAIC and FAW in China.

The Li Xiang One is a large SUV with range extender technology and a 40,6 kWh battery. It became an instant hit and outsells established rivals like the BYD Tang PHEV, Audi e-tron Quattro and BMW X5 PHEV by a wide margin. China sales only, so far.

10,6 Million BEVs & PHEVs Expected for 2022

Global EV sales for 2019 and 2020 stayed below trend. In Europe, the WLTP introduction forced many high-selling PHEV models into the shop for e-range upgrades. In China, regulators cracked down on products with substandard safety and range. Dozens of models had their sales halted and several combatants went out of business. In 2020, the first wave of Covid-19 led to an unprecedented slump in car sales but also to higher subsidies for EVs. In both years, EV sales would have been higher, in a business as usual situation.

2021 was not business as usual either, but EV sales were back on track. 2022 H1 deliveries increased by another 1,65 million units compared to 2021 H1, in a global light vehicle market that lost 3,8 million units during the period. We expect similar gains for EVs in H2, while total vehicle markets return to growth compared to a low base in 2021 H2. Consumption stimuli will boost China volumes, interest rate hikes in USA and Europe will further delay the auto market recovery there.

10,6 million EV sales (at 13,4 % share) in 2022 are still a safe bet, well supported by sales trends, order backlogs, more desirable products and higher public awareness. The downside is in persisting component shortages and events in China and/or Russia leading to further deteriorating business conditions.

Nearly 27 Million EVs On The Road at 2022 Year End

Adding this year’s 10,6 million BEVs and PHEVs to the existing stock gets the number of EVs in operation to nearly 27 million, word-wide, counting light vehicles. With ca 1,5 billion light vehicles in operation, this is still just 1,8 %, counting BEVs only it is less than 1,3 % of the global fleet. The number of vehicle on the road worldwide is increasing by 40 million cars and light trucks every year, as many as the entire current vehicle population of the UK. This year, 8 million of this increase (20 %) are BEVs. The other 32 million newcomers (80 %) are still burning petrol or Diesel. In a scenario towards 100 % zero-emission global vehicle sales in 2040 (as an example for the math), the total number of vehicle in operation reaches 2 billion in 2040. By then, Over 40 % of this stock are BEVs but the sobering truth is also that, with current scrapping rates, over 50 % of vehicles still need to burn fuels. The full transition to BEVs needs to accelerate, because the positive impact on CO2 emissions comes with a considerable delay. Fast EV adoption is a prerequisite for sustainable personal mobility.

Close

Close