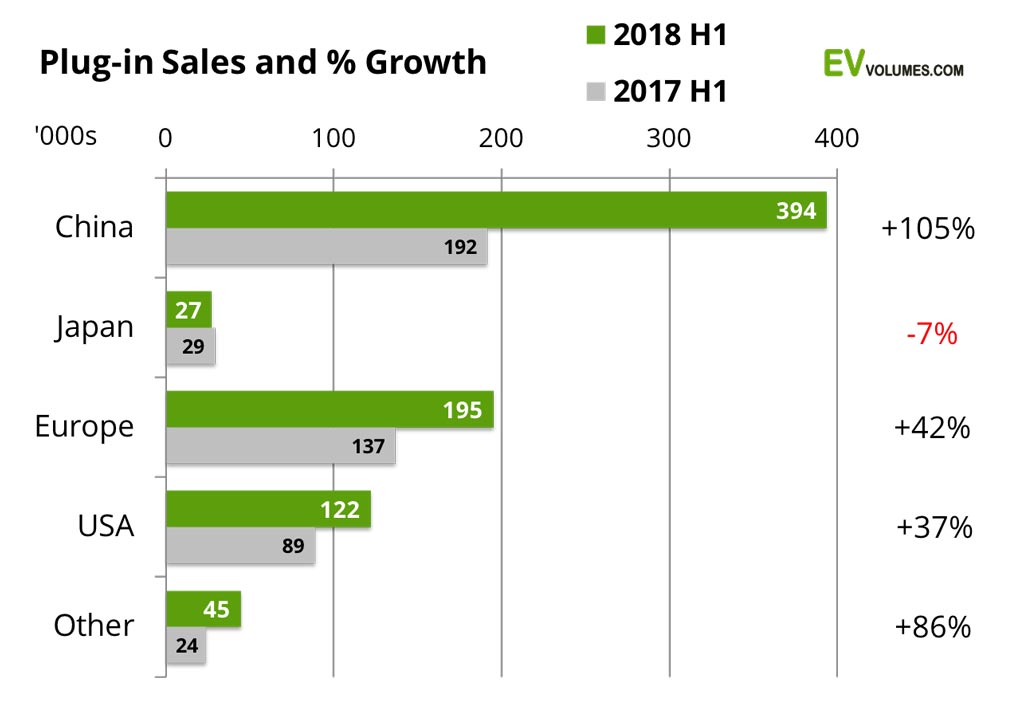

2018 is going to be another great year for plug-ins: 783 000 units were delivered during H1 2018, a gain of 66 % over the same period last year. Preliminary results for July show an increase of 53 % over July 2017. China stands for 51 % of the global volume, so far, and reached a peak share of 4,8 % plug-ins in worlds largest car market. Battery electric vehicles (BEV) stand for 64 % of the global volume, plug-in hybrids (PHEV) for 36 %. This marks the global average, depending on the individual incentive schemes, the mix of battery electric vehicles and plug-in hybrids varies significantly between countries. BEVs can represent as much as 88 % of plug-in sales, like in the Netherlands, or just 12 % like in Finland. The Europe average was 51 % BEV for 2018 H1; in China BEVs stand for 73 %. In USA this number was 53 % until June, now shifting fast towards higher BEV share with more Tesla Model-3 deliveries.

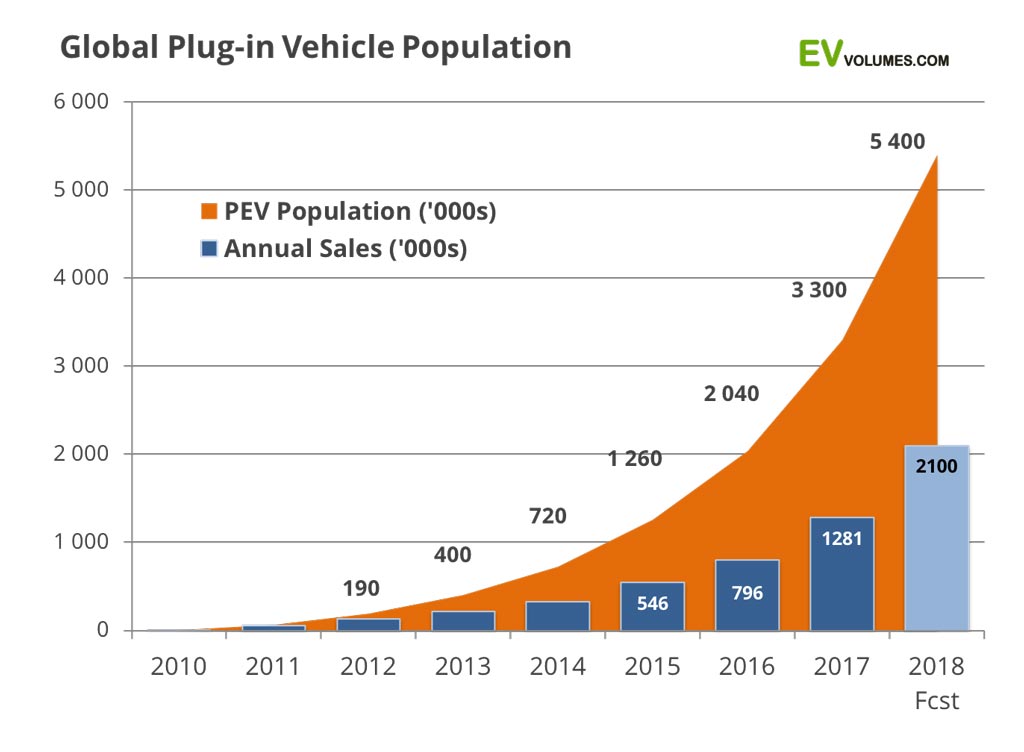

It is safe to predict that global sales of plug-in vehicles will surpass the 2 million mark this year. We are expecting 2,1 million deliveries, a 64 % increase over the 2017 result. This is considering the regional growth trends and the seasonality of sales, with 60-65 % of deliveries occurring in the second half of the year. The above numbers are for battery electric vehicles (BEV) and plug-in hybrids (PHEV) and comprise the light vehicles categories cars, SUVs, MPVs and light commercial vehicles. Medium and heavy commercial vehicles will add another 280 000 sales in 2018, nearly all of them in China. The global plug-in vehicle population will reach approximately 5,4 million light vehicles by the end of 2018, 64 % more than at the end of 2017. Medium and heavy commercial vehicles add 800 000 units to the global stock of plug-ins.

The by far largest growth contributor is China, where we expect sales to increase by over 500 000 units to 1,1 million in 2018. The long awaited Tesla Model-3 will contribute with over 130 000 additional units this year. With deliveries still restricted to USA and Canada in 2018, the Model-3 already was the worlds best selling EV of all categories in June, July, much likely in August and in many months to come. It will completely dominate the North American plug-in vehicle market from now on.

Among the fastest growing markets for the first 6 months were China (+105 %), Canada (+168 %), The Netherlands (+126 %), South Korea (+169 %), Spain (+99 %,) Finland (+148 %), Denmark (+691 %), Portugal (+119 %) and Australia (+98 %). Many Central Europe countries have increased sales 3 to 4-fold, albeit from small bases. The share leader is Norway, as usual, where 37 % of new car sales were Plug-ins this year. Iceland comes 2nd with 14 % and Sweden 3rd with 5 % for 2018 H1 combined. Our Europe story on H1 has more details on this. Among the larger economies, China leads with a plug-in share of 3 %. All other car markets with over 1 million total sales show 2 % or less for H1 combined.

Over 2 million deliveries and over 5 million on the road

Growth in the 2nd quarter has beaten our expectations, with a staggering 70 % more plug-ins sold than in 2017 Q2. In May, the share in the global light vehicle marked reach over 2 %, for the month of December it can go as high as 3,5 %. Inventories for popular model are tight in a number of markets as in Norway, Sweden and Germany. Delivery times of 6 month and more are now common in Europe, where most cars are built to order. OEM have announced production increases for the coming model-year.

We increase our forecast to 2,1 million worldwide plug-in sales for 2018, thereof 350-360k in the US, 420-430k in Europe, 1150k in China and 160k outside the aforementioned. The 2,1 million units include passenger vehicles and light commercial vehicles. It means +64 % in terms of volume increase and a light vehicle industry share of 2,2 %. Two thirds of the 2018 volume are expected to be BEVs.

By the end of 2018, the plug-in vehicle population will reach around 5,4 million worldwide, an increase of 64 % over 2017 year end. Still, the impact on the total vehicle stock will be hardly noticeable in most countries. 5,4 million plug-ins on a global light vehicle population of around 1,3 billion, is just 0,4 %, one in 250. Growth is exponential, though, and the overall picture will change much faster than historic sales suggest. Adoption of successful technology is along S-curves, not straight lines.

China leads growth and volume

China usually starts the year with NEV sales and shares below trend. 2018 had a strong start with +115 % increase in Q1 and +100 % in Q2, including light commercial vehicles. From mid June, new requirements regarding e-range (>150 km) and specific battery capacity (>105 Wh/kg) became effective for subsidy approval. This put a lid on sales of some very popular small and mini-EVs. We expect growth in China to slow down in Q3 and Q4 until OEMs have solved the compliance issues of these models.

Japan is among the very few markets with a contracting plug-in sector this year. More comments about the reasons towards the end of this article.

Europe is a mixed bag, with sales held back by supply constraints in larger EV markets, triple digit %-increases in South and Central Europe, a strong recovery in the The Netherlands and incentive policy adjustments to promote more sales of pure EVs. The increases for total Europe were 40 % in Q1, 45 % in Q2 and 30 % in July.

The USA numbers for January thru June show only partly the Model-3 effect. July deliveries were over 14 000 and August estimates are nearly 18 000 units, pushing total sector growth to 90 % rsp. 120 % in these months.

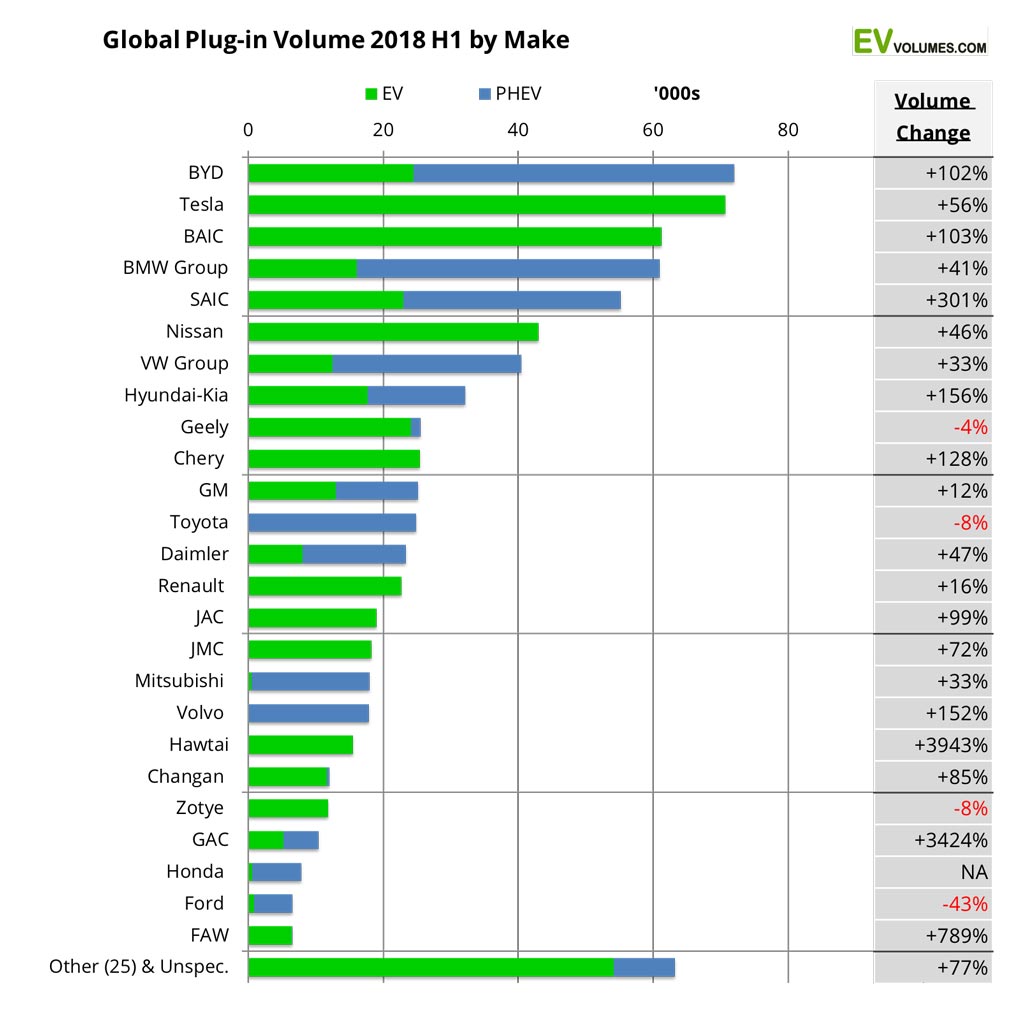

BYD stays on top – for now

BYD leads the ranking for 2018 H1, a position it has held since 2015. BYD delivered 72 000 units in H1, twice as many cars as in 2017 H1, thanks to the success of the new Song SUV and a revised Qin Sedan. Both models are PHEVs. Tesla follows very closely, climbs from #3 in 2017 to #2 in the ranking and is growing faster (Model-3) than BYD now. The top spot for the complete 2018 looks certain for Tesla, with way over 200 000 deliveries worldwide.

Some Chinese OEM were not ready for the new EV battery requirements and lost considerable sales. The worlds best-selling EV in 2017, the BAIC EC180/200 series, had no deliveries in June. ZhiDou (a Geely affiliate) lost all their D1/D2 series volume that month. Clear winners in China were SAIC (Shanghai Automotive), Chery and the newcomers GAC (Guangzhou Automobile) and Hawtai, albeit from small volume bases.

Among the international OEMs, Volvo and Hyundai-Kia gained most share versus last year, while the sector representation of Ford went from bad to worse. Most European OEM do not participate (yet) in the steep plug-in growth in China and their volume gains are below the global sector growth of 66 %.

Beneath the top-25 there are at least another 25 smaller manufacturers for cars and another 10 for electric light commercial vehicles. Most of them are Chinese and operate in their local domain, a city or province. Many of them are EV start-ups, with varying chances for success. Even if badge-engineering is commonplace, there are few signs of sector consolidation, yet. The number of players keeps growing, every month.

Battery Chemistry Evolution

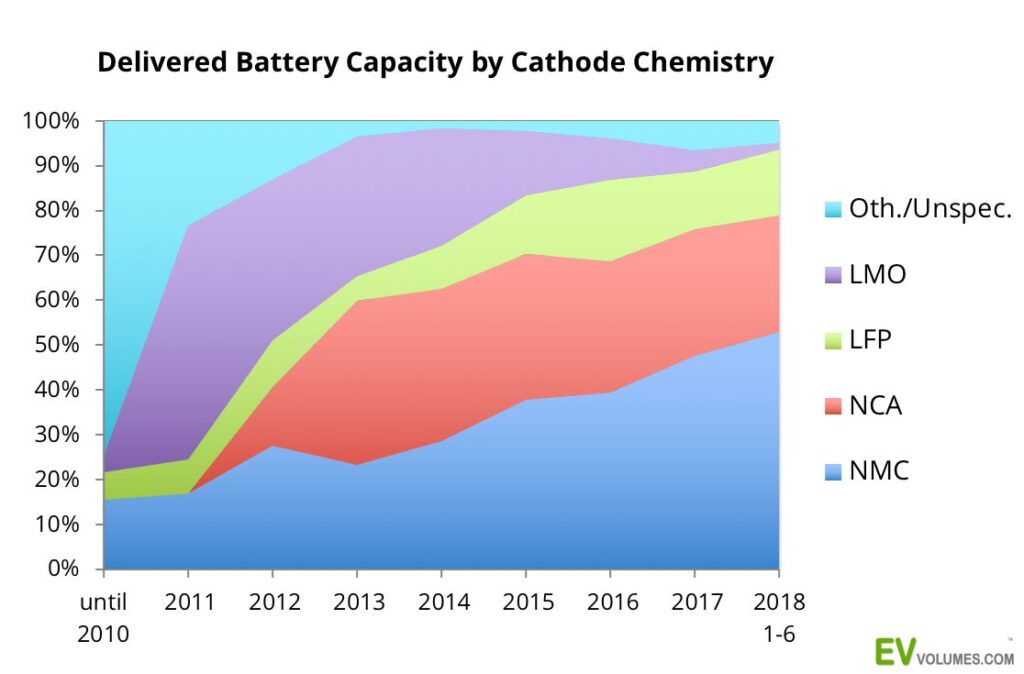

The traction battery landscape has changed a lot in the past 10 years. In absolute shipment terms, the traction battery volume increased from just 1 Gigawatt-hours in 2011 to 37 GWh in 2017, according to our Battery Shipment Tracker. This reflects the rapid increase in plug-in vehicle sales and the increasing battery capacity of those vehicles. These numbers are for the light vehicle sector; heavy vehicles, mostly buses in China, swallowed another 26 GWh last year.

The chart shows how the light vehicle battery shipments developed by their cathode chemistry. Following an experimental phase with a large variety of costly, low volume concepts, the appearance of the Nissan Leaf EV in 2011 lead to the dominance of the LMO type (Lithium Manganese Oxide). NMC (Nickel Manganese Cobalt) batteries went mostly into the GM Volt. The next phase has the fast expansion of Tesla with their large NCA (Nickel Cobalt Aluminium) batteries, developed with Panasonic. Starting 2015, fast growth in China generated more LFP (Lithium Ferro Phosphate) share in the global shipments, mostly supplied by BYD.

Today, the most popular battery chemistry for light vehicles is the NMC family, with their main suppliers CATL, LG Chem and Samsung SDI. Heavy vehicle still rely on LFP batteries, with CATL and BYD as main producers.

The traction battery business is critical for the success of vehicle electrification and we can just scratch the surface here. Feel free to contact us for further insights of our battery database.

Japan rules HEV sales and production

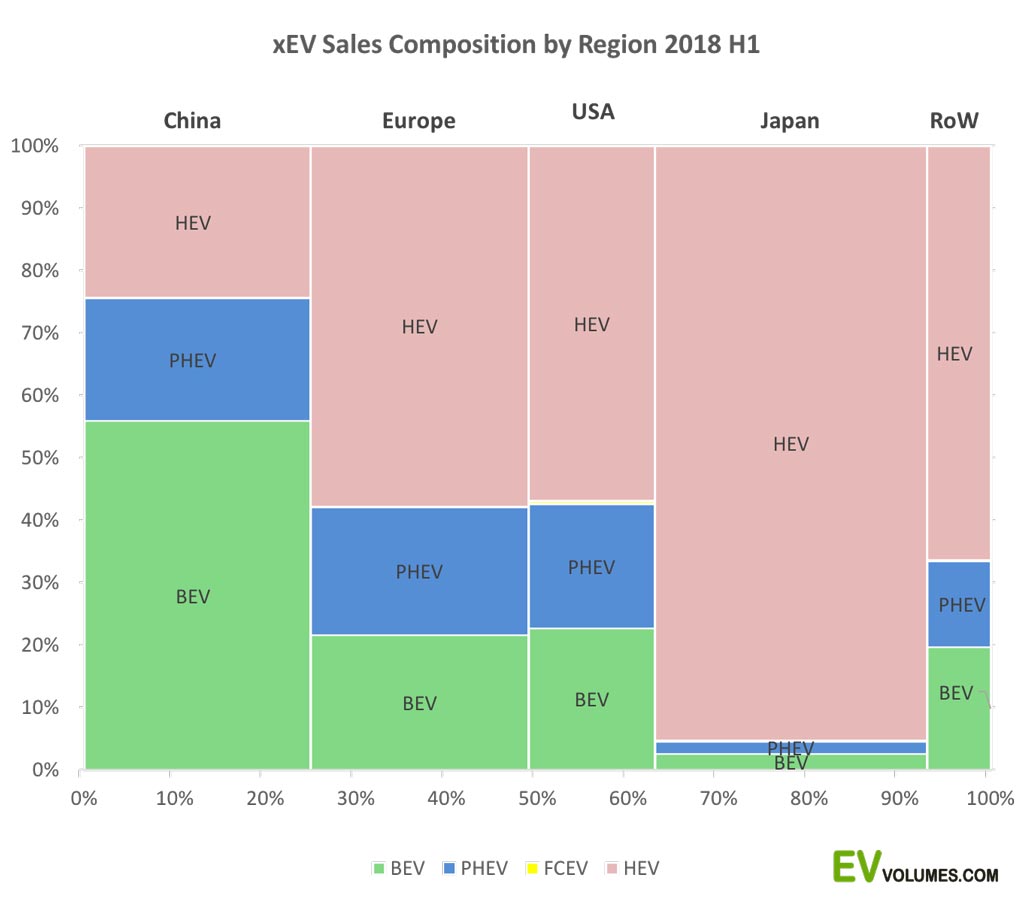

A word on HEVs and on Japan, which does not participate in the rapid growth of plug-ins this year. HEVs do not charge from the grid, have very small traction assist batteries (1,5 to 3 kWh) and very limited all-electric-drive capabilities (if at all). Their advantage is price. The entire space of BEV, PHEV and HEV had a volume of 3,5 million sales units in 2017, BEV 866k, PHEV 415k, HEV 2210k. The map shows the split into geographies and concepts for the first half of 2018, with a total volume of 2 million units. Plug-in vehicles grow faster (+66 % over H1 of 2017) while HEVs increased by just 6 %.

The ties of Japan and HEVs are exceptional: It all started with the Toyota Prius and Honda Insight, now 87 % of all worldwide HEV sales are from Japanese brands, 47 % of all HEV sales reside in Japan and one in four car sales in Japan is a hybrid.

So, why is Japan still hesitant to adopt plug-ins? Solid leadership in HEV design and sales volumes is one reason. Lack of domestic plug-in choices is another: only 6 domestic models are offered, 3 of them (Leaf EV, Prius PHEV and Outlander PHEV) stand for 90 % of all plug-in sales; imports represent a small niche. A strong belief in fuel cell solutions (FCV) and the shutdown of nuclear power plants are other important considerations. Tax savings on eco-cars are similar for PEVs and the best HEVs. Unlike in the other regions, plug-in sales in Japan are unlikely to rally anytime soon.

Close

Close